How Investors Are Reacting To Newegg Commerce (NEGG) Founder Fred Chang’s Return To Board Leadership

- In November 2025, Newegg Commerce announced that founder Fred Chang appointed himself to the Board as Primary Minority Board Appointee, replacing Richard Weil in that role, while Greg Moore left the Board to become an advisor and Fuya Zheng became interim Audit Committee chair.

- This reshaping of Newegg’s governance brings the company’s original founder back into a central oversight position, potentially influencing future board priorities and committee decisions.

- We will now examine how Fred Chang’s return to a leading board role may influence Newegg’s investment narrative and governance outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Newegg Commerce's Investment Narrative?

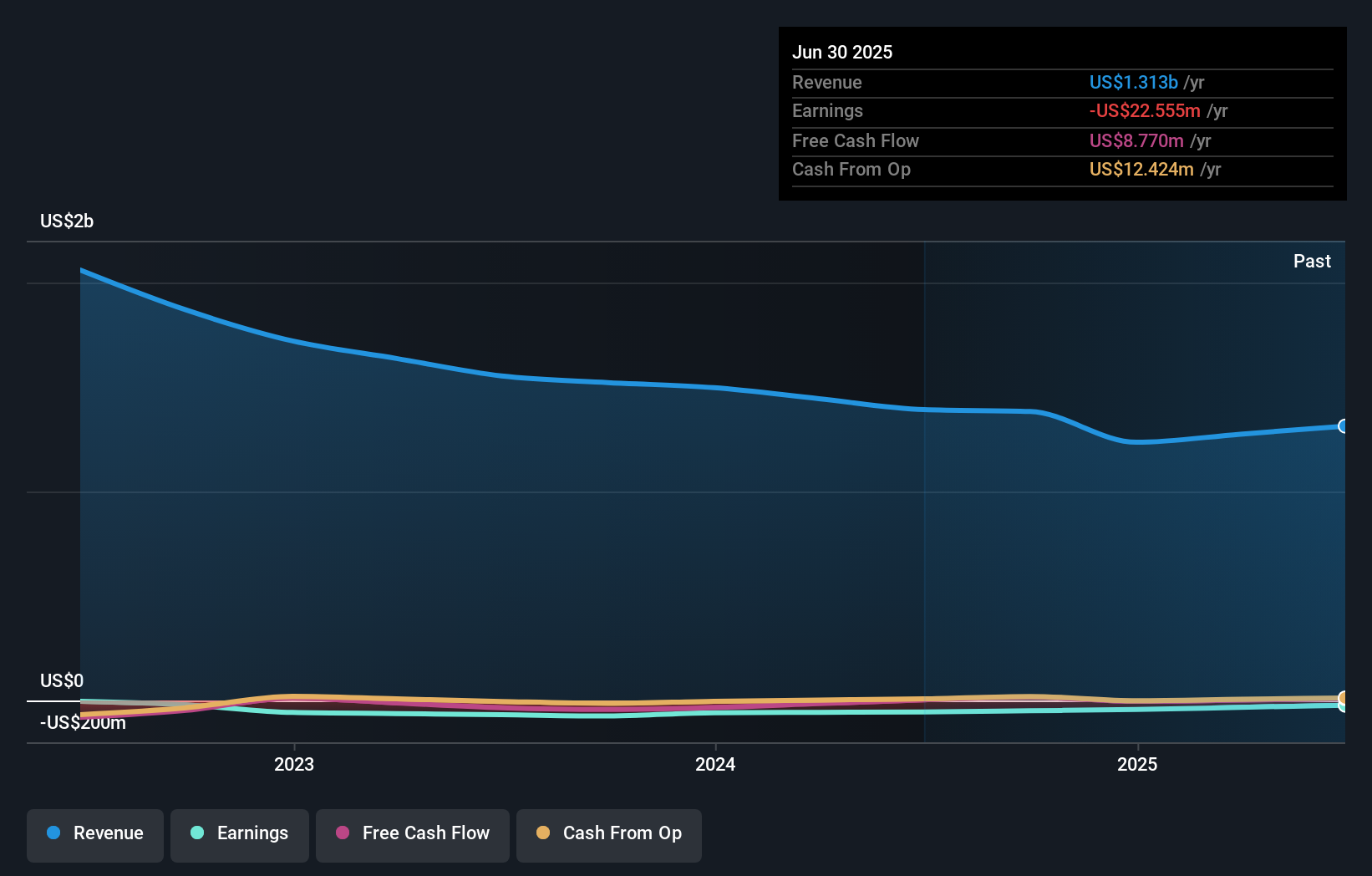

To own Newegg today, you really have to believe the core e-commerce franchise can translate improving sales and narrowing losses into a path toward profitability, despite a long history of deep losses and share price volatility. The recent self-appointment of founder Fred Chang as Primary Minority Board Appointee adds a new twist to that story. In the short term, the main catalysts still look operational: execution against 2025 sales guidance around US$1.38 billion to US$1.42 billion, continued loss reduction from 2024’s US$43.33 million, and whether recent index inclusions can support liquidity after a very large year to date share price move. Chang’s return could become material if it shifts board focus toward bolder strategic or capital allocation moves, but so far the market’s muted reaction suggests investors are waiting to see concrete changes to governance or strategy before reassessing the risk profile.

However, one key governance and valuation risk here is easy to overlook. Newegg Commerce's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 6 other fair value estimates on Newegg Commerce - why the stock might be worth less than half the current price!

Build Your Own Newegg Commerce Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Newegg Commerce research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Newegg Commerce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Newegg Commerce's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal