Should You Buy the Dip in Snowflake Stock Today?

Snowflake (SNOW) stock tanked more than 11% on Dec. 4 after the cloud-based data storage firm reported market-beating financials for its Q3 but issued muted guidance for the future.

According to the company’s earnings release, its operating margin will come in at 7% in the fourth quarter – about 140 basis points below analysts’ consensus.

Despite its post-earnings decline, Snowflake stock remains up an exciting 90% versus its year-to-date low in the first week of April.

Is It Worth Buying the Dip in Snowflake Stock

Long-term investors should consider loading up on SNOW shares on the aforementioned pullback primarily because the company’s artificial intelligence (AI) investments are now showing traction.

The NYSE-listed firm achieved $100 million in AI annual recurring revenue a quarter earlier than anticipated, with artificial intelligence products driving roughly 50% of bookings in its fiscal Q3.

“Snowflake Intelligence” demonstrated the fastest adoption ramp in the company’s history.

Meanwhile, strategic partnerships including a $200 million multi-year agreement with Anthropic strengthen its positioning for enterprise AI transformation initiatives as well.

Snowflake sees its revenue growth reaccelerating to over 30% in the current quarter, offering an additional reason to invest in it at current levels.

Technicals and Valuation Warrant Buying SNOW Shares

From a valuation perspective, the post-earnings weakness has created an attractive entry point for long-term investors willing to tolerate near-term volatility.

At the time of writing, Snowflake shares are trading at about 24x sales only, representing material compression from their historical average of roughly 35 times.

According to Barchart, bullish options traders are currently pricing in a sharp recovery in the AI stock to about $264 within three months. This suggests potential for a 12% rally by late February.

All in all, Snowflakes’ risk-reward profile appears attractive given valuation compression and solid positioning in the artificial intelligence-enabled data analytics market.

On Thursday, UBS analysts also maintained their “Buy” rating on SNOW with a $310 price target indicating potential upside of more than 30% from here.

How Wall Street Recommends Playing Snowflake

Wall Street more broadly recommends sticking with Snowflake stock despite the company’s muted guidance as well.

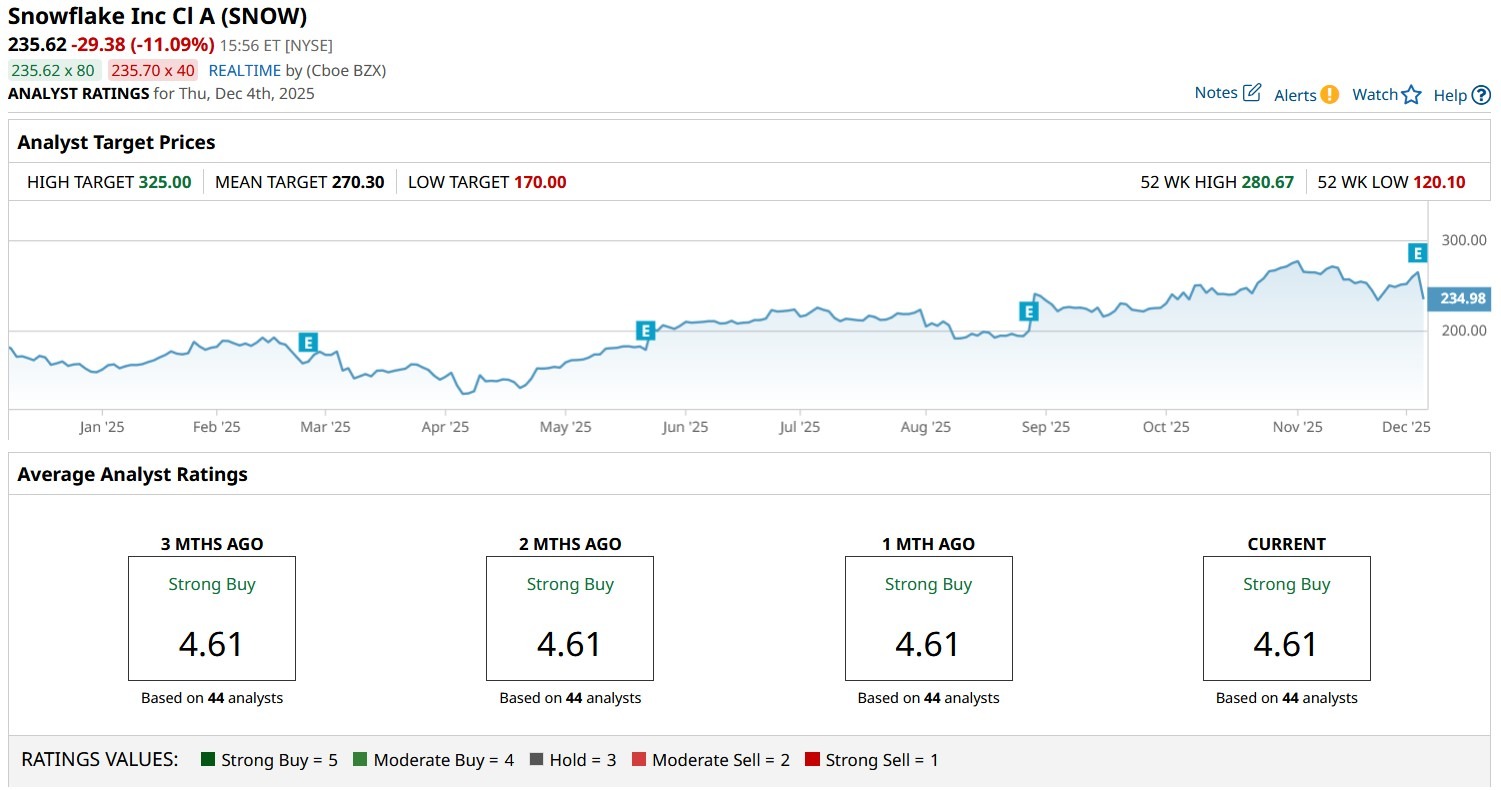

The consensus rating on SNOW stock remains at “Strong Buy” with price targets going as high as $325 indicating potential for a 40% rally from current levels.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal