How Investors Are Reacting To Microsoft (MSFT) Confusion Over Reported AI Sales Target Changes

- In recent days, reports that Microsoft had lowered AI sales targets due to slower-than-expected demand were followed by firm company denials, with Microsoft insisting aggregate quotas and targets for AI products remain unchanged.

- This clash between media accounts and Microsoft's response has drawn attention to how quickly enterprises are actually adopting new AI tools, and what that means for the company’s AI revenue ramp.

- We’ll now examine how this uncertainty around AI sales traction and enterprise adoption interacts with Microsoft’s investment narrative built on large-scale AI and cloud expansion.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Microsoft Investment Narrative Recap

To own Microsoft, you need to believe its heavy AI and cloud spending can keep translating into durable, high-margin growth across Azure and the broader software stack. The latest back-and-forth over alleged AI quota cuts versus Microsoft’s denials primarily affects sentiment around the pace of enterprise AI adoption; it does not yet alter the key near term catalyst of Azure and Copilot monetization, nor the biggest risk that aggressive AI CapEx could outrun realized demand.

Against this backdrop, VitalEdge’s new Insights Agent, built on Microsoft Copilot, is a useful reminder of what the AI thesis looks like on the ground: partners using Microsoft’s tools to embed AI into very specific industry workflows. Examples like this support the idea that AI usage can deepen inside existing Microsoft relationships, even if initial adoption is bumpier than bulls or management might have hoped.

Yet while enthusiasm around Azure and Copilot is high, investors should also be aware that Microsoft’s multibillion dollar AI and data center build out...

Read the full narrative on Microsoft (it's free!)

Microsoft's narrative projects $425.0 billion revenue and $158.4 billion earnings by 2028.

Uncover how Microsoft's forecasts yield a $625.41 fair value, a 31% upside to its current price.

Exploring Other Perspectives

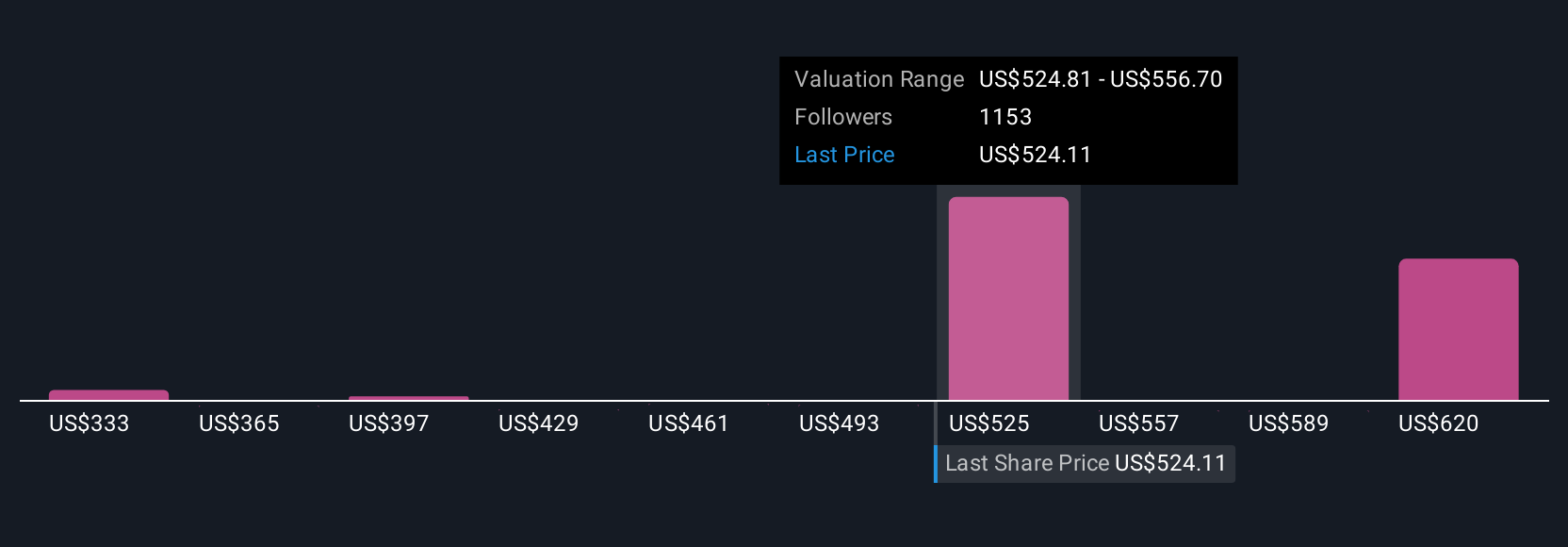

Fair value estimates for Microsoft from 128 Simply Wall St Community members range from US$360 to about US$625, reflecting very different views on upside. Against that backdrop, the key risk that AI driven CapEx could pressure margins if demand underwhelms gives you a concrete lens to compare these opinions and consider how reliant the story has become on sustained AI adoption.

Explore 128 other fair value estimates on Microsoft - why the stock might be worth 25% less than the current price!

Build Your Own Microsoft Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Microsoft research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Microsoft research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Microsoft's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal