Valaris (VAL) Is Up 8.0% After AI-Driven Funds Flag Strong Trading Signals - Has The Bull Case Changed?

- In recent days, Valaris Limited has attracted increased attention as institutional AI-driven trading strategies highlighted strong multi-timeframe signals and identified specific entry, target, and risk-management parameters around the stock.

- What stands out is how sophisticated, signal-based approaches used by larger traders appear to be shaping broader market sentiment toward Valaris at both near-term and long-term horizons.

- We’ll now examine how this surge in AI-driven positive trading signals may influence Valaris’ existing investment narrative and risk profile.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Valaris Investment Narrative Recap

To own Valaris, you generally need to believe that offshore drilling remains an essential part of global energy supply and that its high-spec fleet and backlog can translate into resilient cash flows despite industry cycles. The recent AI-driven trading signals appear to be more about short term positioning than fundamentals, so they do not materially change the key near term catalyst of contract awards or the major risk around future offshore demand and regulation.

The recent US$140 million contract award for VALARIS DS-12 with BP in Egypt, starting in 2Q 2026, looks most relevant here, as it reinforces the backlog story at the same time that AI models are flagging near and long term trading signals. For investors, combining this growing backlog with signal driven trading interest may sharpen the focus on how quickly new contracts convert into revenue and how sensitive that progress is to project timing.

Yet, while trading signals look constructive today, investors should be aware of how overcapacity and potential day rate softness could...

Read the full narrative on Valaris (it's free!)

Valaris' narrative projects $2.4 billion revenue and $453.7 million earnings by 2028. This implies a 1.2% yearly revenue decline and a $178.2 million earnings increase from $275.5 million today.

Uncover how Valaris' forecasts yield a $55.10 fair value, a 9% downside to its current price.

Exploring Other Perspectives

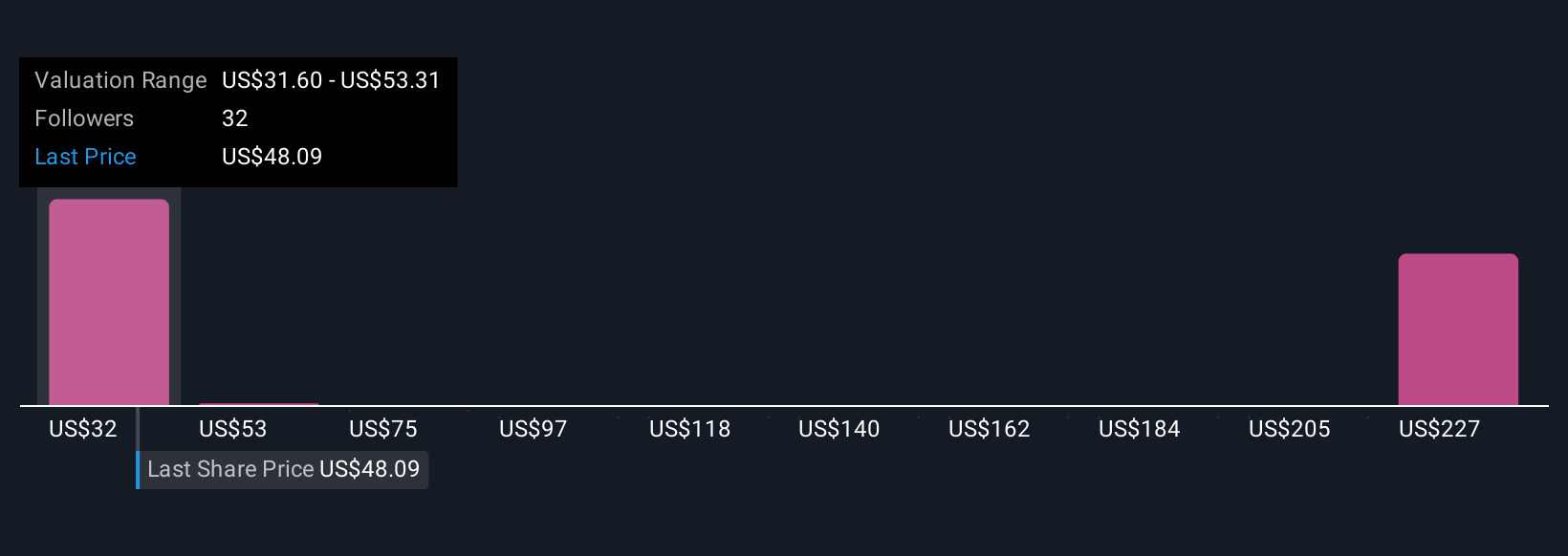

Nine fair value estimates from the Simply Wall St Community span roughly US$32 to US$338 per share, showing how far apart individual views can be. As you weigh those opinions against the risk of overcapacity and weaker day rates, it becomes even more important to compare several perspectives before forming a view on Valaris.

Explore 9 other fair value estimates on Valaris - why the stock might be worth 48% less than the current price!

Build Your Own Valaris Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valaris research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Valaris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valaris' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal