Mereo BioPharma Group And 2 Undervalued Penny Stocks To Watch

Major U.S. stock indexes recently closed higher, with the Dow Jones Industrial Average adding 400 points as investors shrugged off a decline in private employment figures. In this context, penny stocks—often associated with smaller or newer companies—remain an intriguing investment area despite their outdated term. By focusing on those with strong financials and potential for growth, investors can uncover opportunities within these lower-priced stocks that may offer stability and upside potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Here Group (HERE) | $3.08 | $249.08M | ✅ 3 ⚠️ 2 View Analysis > |

| Dingdong (Cayman) (DDL) | $1.83 | $383.61M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.88 | $683.54M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8807 | $148.36M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.215 | $541.81M | ✅ 4 ⚠️ 2 View Analysis > |

| FinVolution Group (FINV) | $4.96 | $1.25B | ✅ 3 ⚠️ 1 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.61 | $362.82M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.8377 | $5.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.06 | $91.76M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 345 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Mereo BioPharma Group (MREO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mereo BioPharma Group plc is a biopharmaceutical company focused on developing and commercializing therapeutics for oncology and rare diseases across the United Kingdom, the United States, and internationally, with a market cap of $311.90 million.

Operations: Mereo BioPharma Group plc has not reported any specific revenue segments.

Market Cap: $311.9M

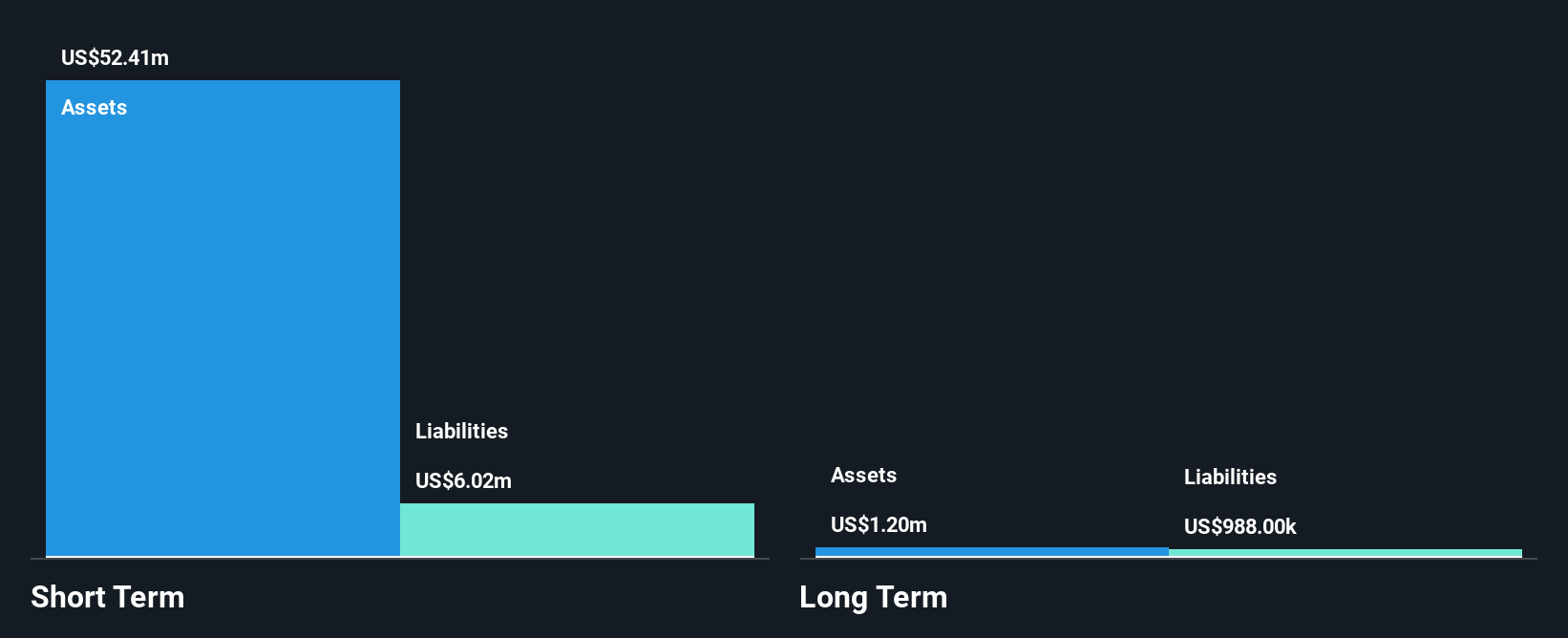

Mereo BioPharma Group, with a market cap of US$311.90 million, is a pre-revenue biopharmaceutical company focused on oncology and rare diseases. Recent earnings reports show reduced net losses, indicating progress in financial management despite ongoing unprofitability. The company's short-term assets significantly exceed both its short and long-term liabilities, providing a solid financial cushion. Mereo remains debt-free with sufficient cash runway for over a year based on current free cash flow levels. While the company has not diluted shareholder value recently, its negative return on equity reflects challenges in achieving profitability amidst substantial forecasted earnings growth of 75.36% annually.

- Unlock comprehensive insights into our analysis of Mereo BioPharma Group stock in this financial health report.

- Explore Mereo BioPharma Group's analyst forecasts in our growth report.

Mammoth Energy Services (TUSK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mammoth Energy Services, Inc. is an energy services company operating in the United States, Canada, and internationally with a market cap of $103.62 million.

Operations: The company's revenue is primarily derived from its Infrastructure segment, generating $111.31 million, followed by the Sand segment with $19.96 million.

Market Cap: $103.62M

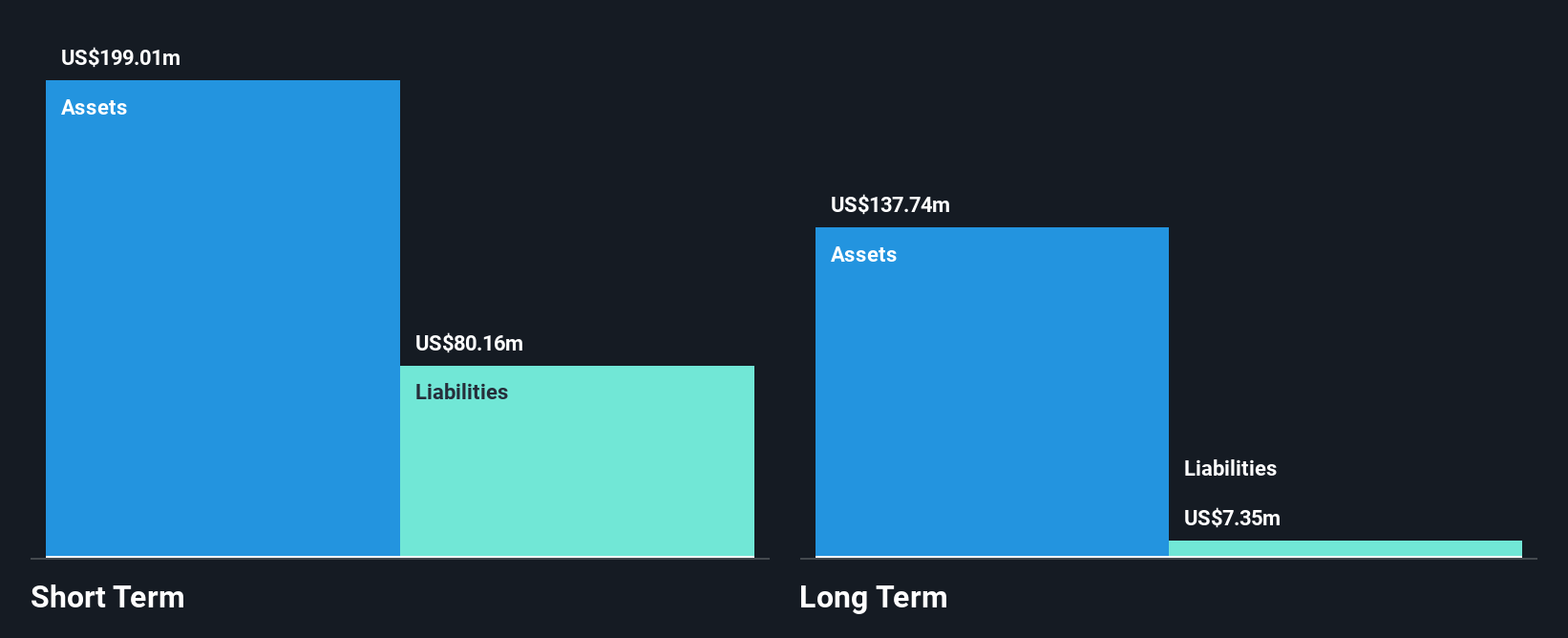

Mammoth Energy Services, with a market cap of US$103.62 million, has seen its debt to equity ratio reduce significantly over five years, now holding more cash than total debt. Despite being unprofitable and facing increased losses at 10.3% annually over the past five years, the company maintains a positive free cash flow and sufficient cash runway for over three years. Its short-term assets exceed both short and long-term liabilities, providing financial stability. Recent earnings reports show decreased net losses compared to previous periods; however, revenue has declined slightly year-over-year without shareholder dilution in recent buyback activities.

- Take a closer look at Mammoth Energy Services' potential here in our financial health report.

- Assess Mammoth Energy Services' previous results with our detailed historical performance reports.

VAALCO Energy (EGY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: VAALCO Energy, Inc. is an independent energy company focused on acquiring, exploring, developing, and producing crude oil, natural gas, and natural gas liquids in Gabon, Egypt, Equatorial Guinea, Cote d'Ivoire, and Canada with a market cap of $362.82 million.

Operations: The company's revenue is entirely derived from its activities in the exploration and production of hydrocarbons, totaling $389.95 million.

Market Cap: $362.82M

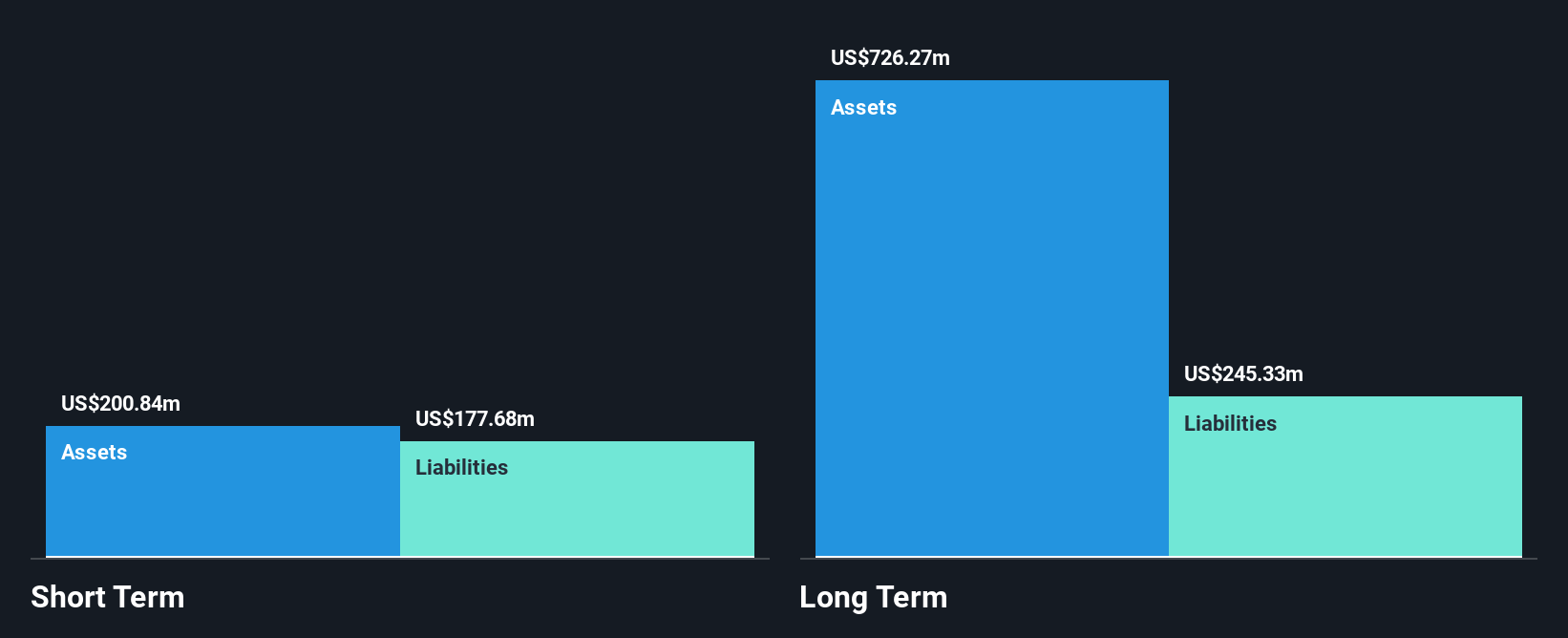

VAALCO Energy, with a market cap of US$362.82 million, faces challenges with declining profitability as evidenced by its recent earnings report showing a drop in net income to US$1.1 million for Q3 2025 from US$10.99 million the previous year. The company maintains a satisfactory net debt to equity ratio of 7.1%, and its interest payments are well covered by EBIT at 11.2 times coverage, indicating manageable financial leverage. Despite lower profit margins compared to last year and an unsustainable dividend yield of 6.93%, VAALCO's earnings are forecasted to grow annually by 30%, suggesting potential future upside if operational improvements materialize.

- Jump into the full analysis health report here for a deeper understanding of VAALCO Energy.

- Assess VAALCO Energy's future earnings estimates with our detailed growth reports.

Taking Advantage

- Discover the full array of 345 US Penny Stocks right here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal