How Google-Backed Fluidstack Deal and Barber Lake Expansion Will Impact Cipher Mining (CIFR) Investors

- Cipher Mining Inc. previously announced a 10-year high-performance computing colocation agreement with Fluidstack at its 300 MW Barber Lake site in Texas, expected to generate approximately US$830 million in contracted revenue, with extension options that could lift the Fluidstack lease value to around US$2.00 billion and US$9.00 billion in total for the entire site.

- A key feature of this deal is Google’s US$333 million backstop of Fluidstack’s lease obligations, which supports project-related debt and underpins Cipher’s plan to fund the Barber Lake expansion with committed financing and approximately US$118 million of additional equity.

- We’ll now examine how this long-term Fluidstack agreement, underpinned by Google’s financial support, reshapes Cipher Mining’s investment narrative and risk profile.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Cipher Mining Investment Narrative Recap

To own Cipher Mining today, you need to believe it can successfully reposition from a Bitcoin miner into a long-term AI and HPC infrastructure landlord, with contracted leases offsetting crypto cyclicality. The Fluidstack deal, backed by Google’s US$333 million support, directly reinforces that pivot and appears to strengthen the main short term catalyst of securing and funding large-scale HPC tenants, while also increasing the importance of execution and capital allocation as key risks.

The most relevant recent development alongside Fluidstack is Cipher’s US$5.5 billion, 15-year lease with Amazon Web Services for AI data center capacity, which, together with Barber Lake, brings total contracted AI and HPC leases to about US$9.3 billion. For investors focused on near term drivers, these agreements substantially shift the story toward contracted, long-duration compute revenue while reducing the relative weight of pure Bitcoin exposure in the catalyst mix.

Yet, despite these long-term leases, investors should still be aware that...

Read the full narrative on Cipher Mining (it's free!)

Cipher Mining’s narrative projects $696.2 million in revenue and $91.1 million in earnings by 2028. This requires 63.6% yearly revenue growth and a $245.1 million earnings increase from -$154.0 million today.

Uncover how Cipher Mining's forecasts yield a $27.25 fair value, a 46% upside to its current price.

Exploring Other Perspectives

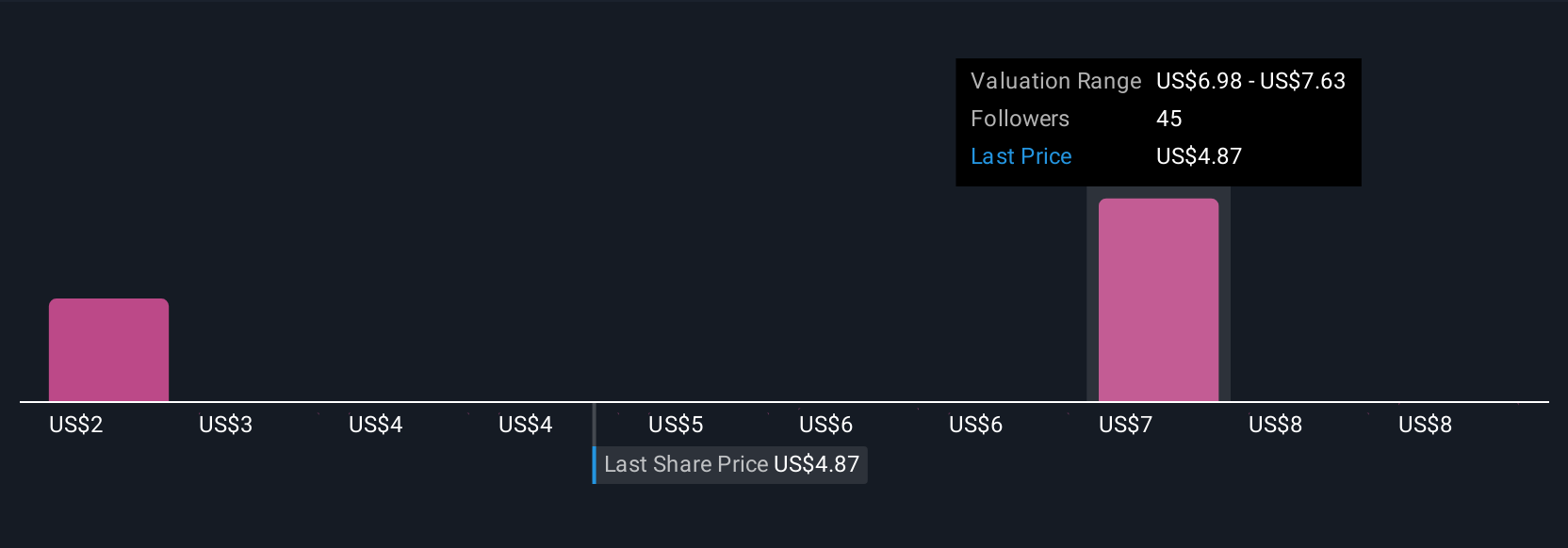

Six fair value estimates from the Simply Wall St Community range from US$6.00 to US$27.25, showing very different views on Cipher’s potential. Against that spread of opinions, the shift toward long-term AI and HPC leases highlights how much future returns may depend on execution rather than Bitcoin cycles alone.

Explore 6 other fair value estimates on Cipher Mining - why the stock might be worth less than half the current price!

Build Your Own Cipher Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Cipher Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cipher Mining's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal