Why Hilan (TASE:HLAN) Is Up 5.8% After Posting Higher Q3 2025 Sales and EPS

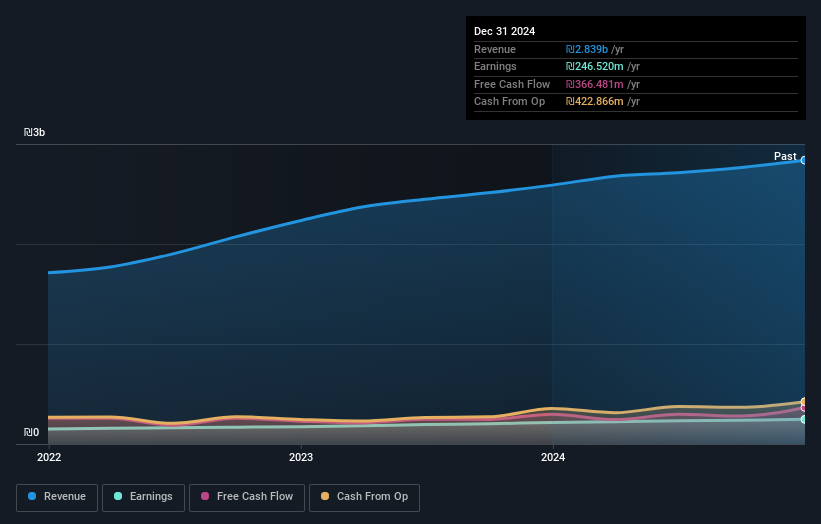

- In November 2025, Hilan Ltd. reported third-quarter 2025 sales of ILS 716.49 million and net income of ILS 55.8 million, both higher than a year earlier, alongside increased basic and diluted earnings per share from continuing operations.

- Over the first nine months of 2025, Hilan’s rising sales to ILS 2.20 billion and higher earnings per share point to ongoing profitability gains compared with the prior year.

- With Hilan reporting higher earnings per share from continuing operations, we will explore how this shapes the company’s broader investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Hilan's Investment Narrative?

To own Hilan, you really need to believe in its ability to keep converting steady, mid‑single‑digit revenue growth into consistently high returns on equity, supported by experienced management and a resilient client base. The latest Q3 2025 results, with higher sales and earnings per share from continuing operations, broadly reinforce that story rather than change it, and the share price’s roughly 26% gain over the past year suggests the market was already rewarding that consistency. In the short term, the key catalysts still look operational: maintaining margin quality, defending pricing in professional services, and justifying Eli’s above‑average compensation with continued execution. The new earnings beat makes the near‑term risk/reward a little more comfortable, but it does not erase concerns about slower forecast growth than the wider Israeli market.

However, investors should not ignore how slower expected growth could eventually pressure Hilan’s premium valuation. Hilan's shares are on the way up, but they could be overextended by 9%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Hilan - why the stock might be worth 8% less than the current price!

Build Your Own Hilan Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilan research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Hilan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilan's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal