Can Best Buy’s (BBY) New Riot Games Ties Reboot Its Gaming and Digital Growth Story?

- Best Buy recently appointed Dylan Jadeja, CEO of Riot Games and former Goldman Sachs retail banker, to its Board of Directors, adding deep gaming, digital and finance expertise, while also reporting third-quarter fiscal 2025 results that showed higher sales but lower net income, recording US$171 million of impairments, maintaining its US$0.95 dividend and continuing share repurchases under its 2022 program.

- Seen together with slightly raised fiscal 2026 revenue and comparable sales guidance and new fourth-quarter outlook, these updates highlight Best Buy’s focus on shareholder returns and its intent to strengthen its position in gaming and digital content through board-level experience.

- We’ll now examine how bringing Riot Games’ CEO onto the board could influence Best Buy’s investment narrative around services, gaming, and digital growth.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Best Buy Investment Narrative Recap

To own Best Buy, you need to believe its stores, services and digital capabilities can still matter in a world of intense online competition and fast tech cycles. The immediate catalyst is execution on services and the coming PC upgrade cycle, while the key risk is pressure on profitability from lower margin categories and promotions. The latest results and the Riot Games CEO board appointment do not materially change those short term drivers yet.

The most relevant update here is Best Buy’s slightly raised fiscal 2026 revenue and comparable sales guidance, which sits alongside modest fourth quarter expectations and ongoing impairments. Together with steady dividends and continued buybacks, this frames a company investing in digital and gaming credibility at the board level while still needing to prove it can translate better top line trends into healthier earnings.

Yet investors should be aware that rising exposure to lower margin gaming and computing could still weigh on profitability if...

Read the full narrative on Best Buy (it's free!)

Best Buy's narrative projects $44.5 billion revenue and $1.5 billion earnings by 2028. This requires 2.3% yearly revenue growth and a $722.0 million earnings increase from $778.0 million today.

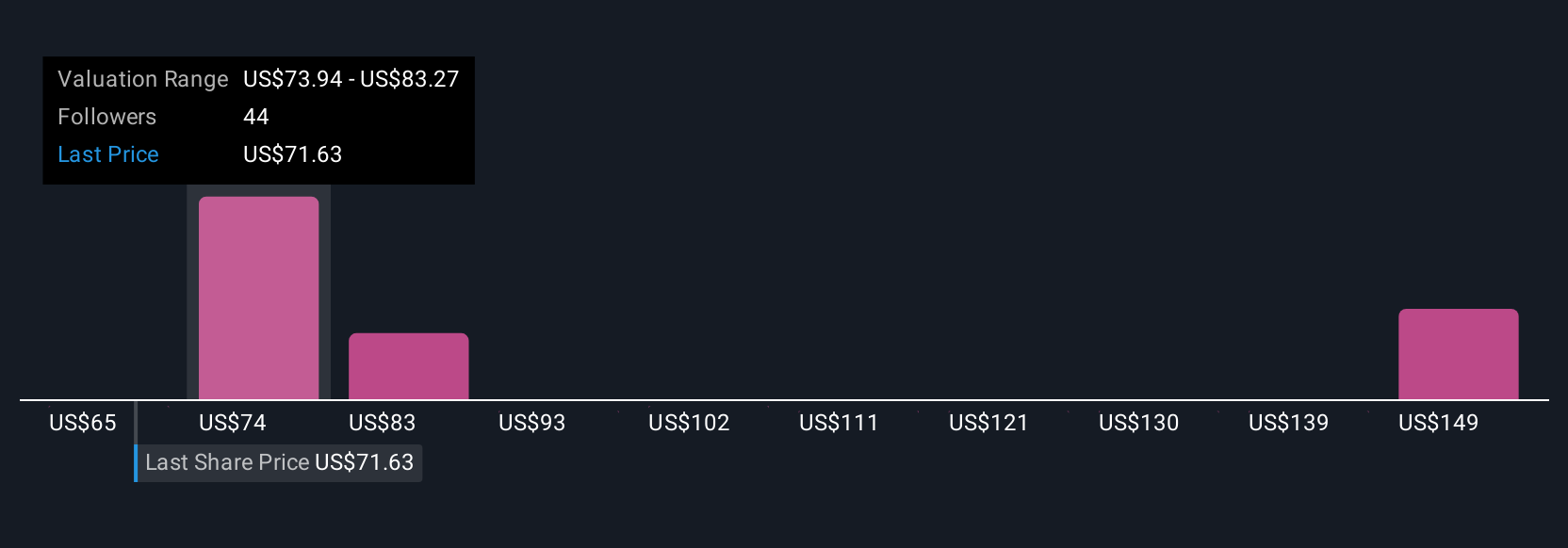

Uncover how Best Buy's forecasts yield a $83.95 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community value Best Buy between US$64.62 and US$171.43 per share, reflecting very different expectations. When you set these against concerns about margin pressure from lower margin tech categories, it becomes clear why you may want to compare several viewpoints before deciding how this business fits into your portfolio.

Explore 6 other fair value estimates on Best Buy - why the stock might be worth 13% less than the current price!

Build Your Own Best Buy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Best Buy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Best Buy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Best Buy's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal