What Southern Copper (SCCO)'s Q3 Earnings Beat and Insider Sale Means For Shareholders

- Southern Copper reported third-quarter 2025 results that exceeded earnings and revenue expectations, while director Luis Miguel Palomino Bonilla sold 400 shares on 3 December 2025.

- The earnings beat highlights the miner’s recent operational strength, drawing fresh attention to how its expansion plans and cost discipline may support future performance.

- We’ll now explore how Southern Copper’s stronger-than-expected quarterly results may influence its existing investment narrative and outlook for growth.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Southern Copper Investment Narrative Recap

To own Southern Copper, you generally need to believe in sustained demand for copper and the company’s ability to execute large, long term projects while keeping costs in check. The third quarter 2025 earnings beat reinforces that operational story, but it does not materially change the key near term catalyst, which is project delivery against its sizeable capex pipeline, nor the biggest current risk around cost inflation and community or regulatory disruptions.

The board’s October 2025 decision to lift the quarterly cash dividend to US$0.90 per share, alongside a small stock dividend, is the recent announcement most closely tied to this earnings surprise. It connects directly to the catalyst of converting strong current profitability into shareholder returns, while still balancing the pressure of more than US$15,000,000,000 in planned capital spending and the operational risks around assets such as Los Chancas.

Yet despite the strong quarter, investors should also be aware that...

Read the full narrative on Southern Copper (it's free!)

Southern Copper's narrative projects $13.0 billion revenue and $4.3 billion earnings by 2028. This requires 3.1% yearly revenue growth and a $0.7 billion earnings increase from $3.6 billion today.

Uncover how Southern Copper's forecasts yield a $118.29 fair value, a 15% downside to its current price.

Exploring Other Perspectives

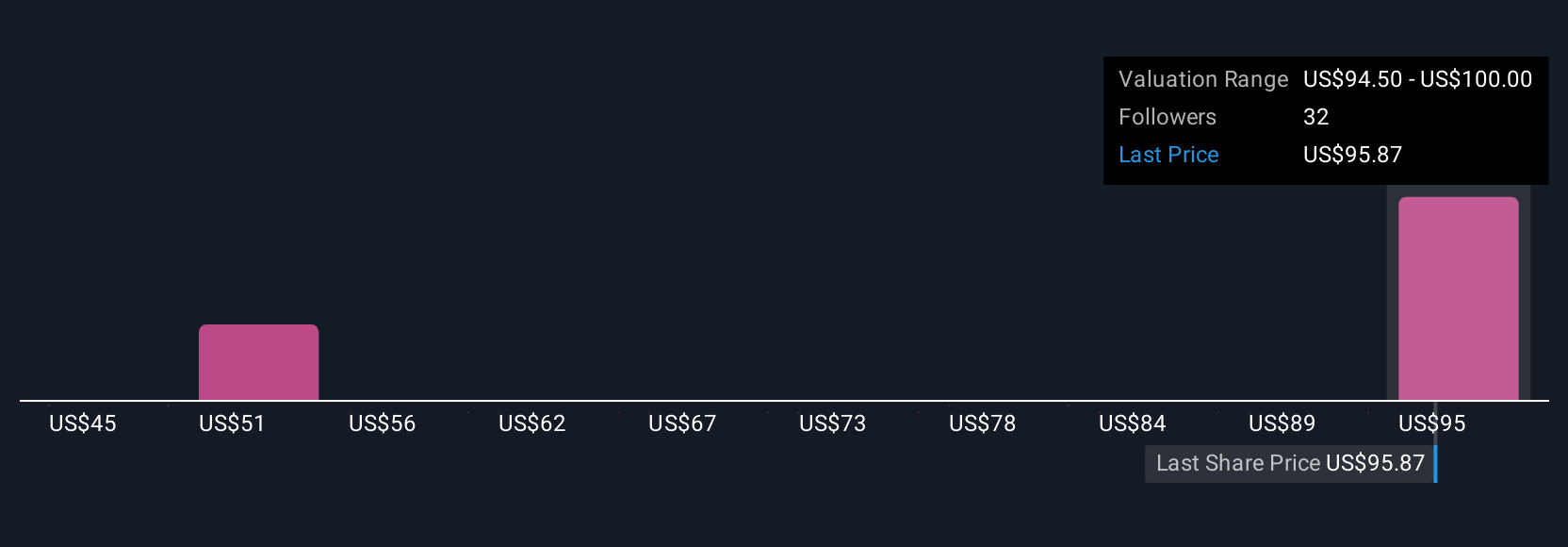

Four members of the Simply Wall St Community currently place Southern Copper’s fair value between US$100 and about US$125 per share, revealing a wide spread of opinion. You are seeing these differing views at a time when strong recent earnings have increased focus on how reliably Southern Copper can execute its large capex program without eroding margins or project timelines.

Explore 4 other fair value estimates on Southern Copper - why the stock might be worth 28% less than the current price!

Build Your Own Southern Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Copper research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southern Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Copper's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal