Does Broad S&P Index Inclusion Reshape the AI-Driven Bull Case for Upwork (UPWK)?

- In late November 2025, Upwork Inc. was added to multiple S&P indices, including the S&P 600, S&P 1000, S&P 600 Industrials sector, and the S&P Composite 1500, elevating its presence in key US equity benchmarks.

- This broad index inclusion increases the likelihood of higher index-tracking fund participation and greater institutional attention to Upwork’s evolving business model.

- We’ll now examine how Upwork’s broad S&P index inclusion may influence its AI-focused investment narrative and long-term earnings profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Upwork Investment Narrative Recap

To own Upwork, you need to believe its AI-enabled marketplace can keep deepening client spend and freelancer engagement despite choppy macro demand and enterprise budget sensitivity. The broad S&P index inclusions may modestly support liquidity and institutional awareness, but they do not fundamentally change the near term risk that slow new client acquisition and cautious enterprise spending could cap revenue and gross services volume growth.

The recent Q3 2025 earnings and guidance context this index news more directly, as they show Upwork operating profitably while still facing a mixed demand backdrop. With revenue guidance for Q4 2025 at US$193 million to US$198 million and a clear focus on disciplined cost control, investors can better weigh whether increased index-tracking ownership aligns with the company’s AI-led product investments and earnings ambitions.

Yet beneath the index headlines, one risk that investors should be aware of is...

Read the full narrative on Upwork (it's free!)

Upwork’s narrative projects $906.3 million revenue and $147.8 million earnings by 2028. This requires 5.5% yearly revenue growth and a $97.6 million earnings decrease from $245.4 million today.

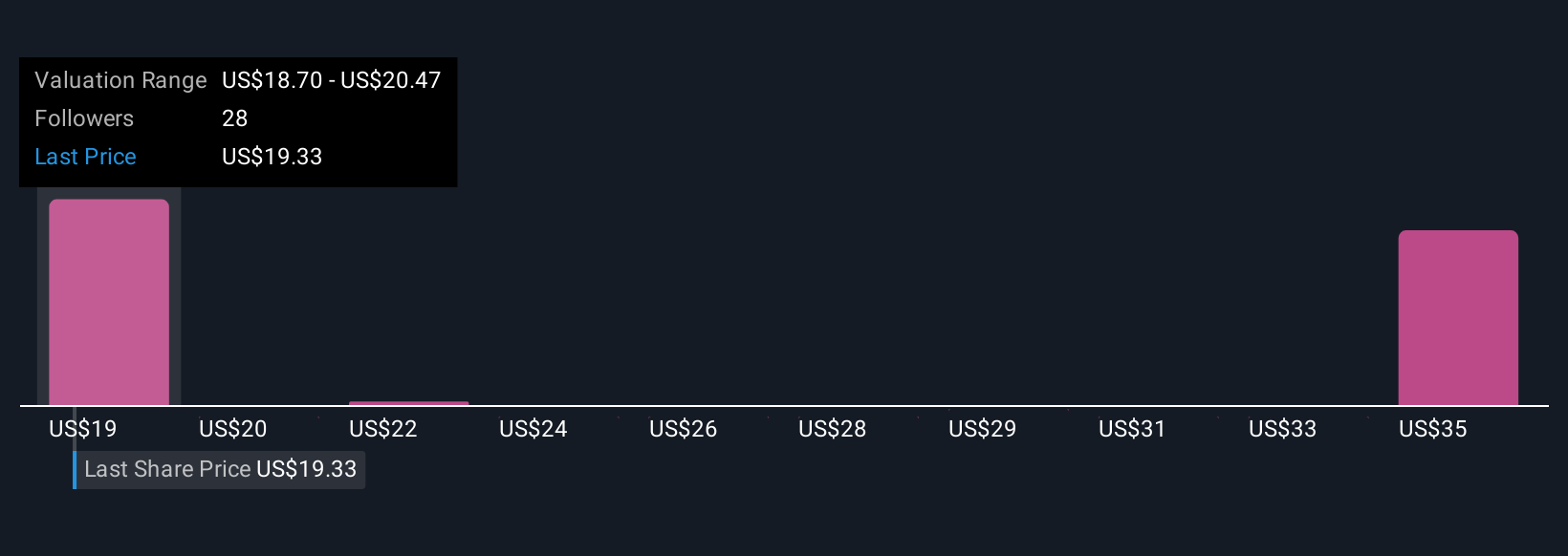

Uncover how Upwork's forecasts yield a $22.60 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates, ranging from US$22.60 to about US$31.00, show how widely individual views can differ. When you set those alongside the risk that macro uncertainty and slow client acquisition could dampen revenue and gross services volume growth, it becomes even more important to compare multiple perspectives on Upwork’s long term prospects.

Explore 4 other fair value estimates on Upwork - why the stock might be worth as much as 51% more than the current price!

Build Your Own Upwork Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upwork research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Upwork research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upwork's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal