Monte Rosa Therapeutics, Inc. (NASDAQ:GLUE) Stock Catapults 28% Though Its Price And Business Still Lag The Industry

Despite an already strong run, Monte Rosa Therapeutics, Inc. (NASDAQ:GLUE) shares have been powering on, with a gain of 28% in the last thirty days. The last 30 days bring the annual gain to a very sharp 67%.

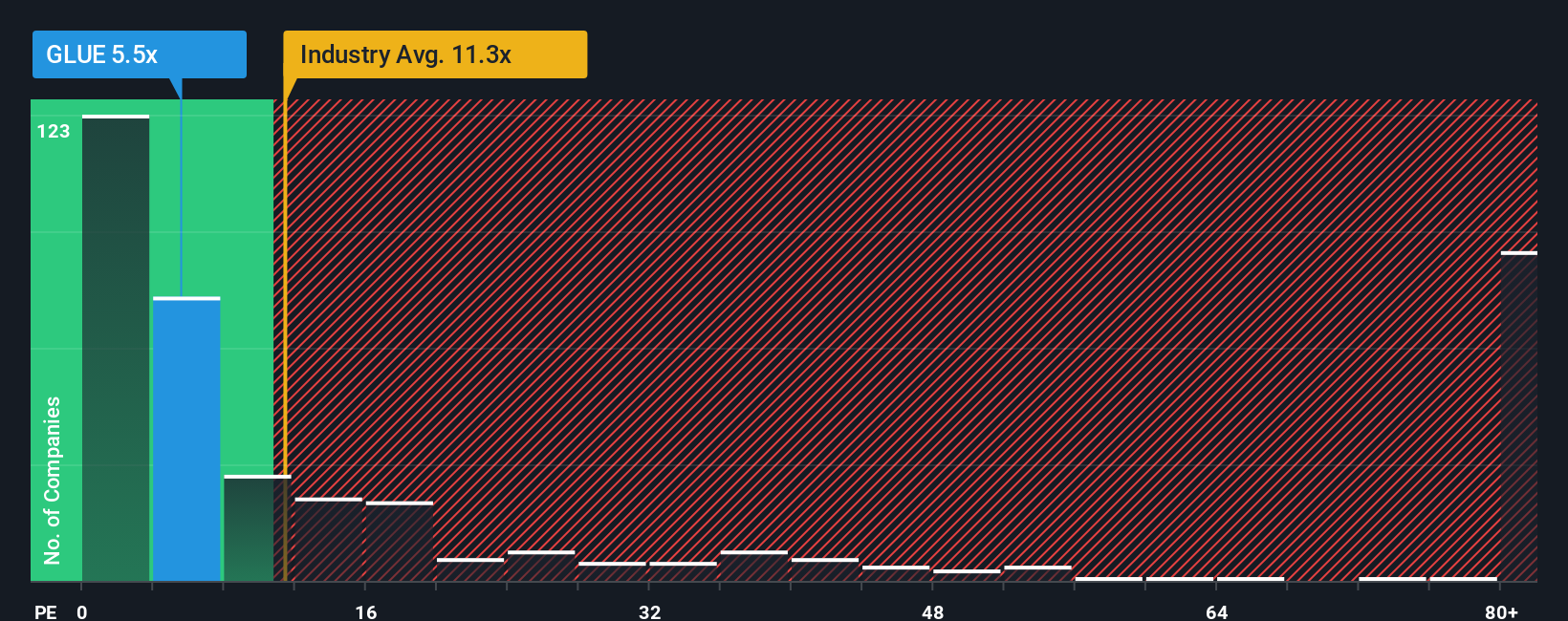

In spite of the firm bounce in price, Monte Rosa Therapeutics' price-to-sales (or "P/S") ratio of 5.5x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.3x and even P/S above 96x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Monte Rosa Therapeutics

How Has Monte Rosa Therapeutics Performed Recently?

With revenue growth that's superior to most other companies of late, Monte Rosa Therapeutics has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Monte Rosa Therapeutics will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Monte Rosa Therapeutics would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 34% each year as estimated by the seven analysts watching the company. With the industry predicted to deliver 124% growth per year, that's a disappointing outcome.

With this in consideration, we find it intriguing that Monte Rosa Therapeutics' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Monte Rosa Therapeutics' recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Monte Rosa Therapeutics' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Monte Rosa Therapeutics' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Plus, you should also learn about these 2 warning signs we've spotted with Monte Rosa Therapeutics (including 1 which is potentially serious).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal