Should Activist Push for Oilfield Services Spin-Off Require Action From Baker Hughes (BKR) Investors?

- On November 23, 2025, Ananym Capital Management LP publicly urged Baker Hughes to spin off its Oilfield Services and Equipment segment, arguing that separating it from the Industrial & Energy Technologies business could unlock substantial value and build on the company’s leading position in LNG turbomachinery with a 95% global footprint.

- Ananym Capital’s willingness to become more assertive if progress stalls, alongside Baker Hughes’ ongoing review of capital allocation, costs, and operations, raises the prospect of meaningful portfolio reshaping for investors to monitor.

- We’ll now explore how this push for an Oilfield Services and Equipment spin-off could reshape Baker Hughes’ investment narrative and future direction.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Baker Hughes Investment Narrative Recap

To own Baker Hughes today, you need to believe in its ability to balance a still-cyclical Oilfield Services & Equipment business with growing Industrial & Energy Technologies, particularly LNG turbomachinery. Ananym Capital’s call for a spin-off introduces the possibility of portfolio change, but the core near term catalyst remains execution on high margin, energy transition aligned projects, while the biggest risk is still exposure to volatile upstream spending and commodity driven order cycles.

The most relevant recent update here is Baker Hughes’ Q3 2025 earnings, which showed modest year on year sales growth but lower net income and EPS. That mix of resilient revenue and softer profitability frames how any potential separation of Oilfield Services & Equipment might affect margins, capital allocation, and the company’s ability to keep building on its Industrial & Energy Technologies backlog and LNG positioning.

But investors should also be aware that concentrated exposure to upstream oil and gas leaves Baker Hughes vulnerable if...

Read the full narrative on Baker Hughes (it's free!)

Baker Hughes’ outlook projects $29.1 billion in revenue and $2.9 billion in earnings by 2028. This implies revenue growing at 1.8% per year, while earnings are forecast to decline by about $0.1 billion from $3.0 billion today.

Uncover how Baker Hughes' forecasts yield a $52.57 fair value, a 6% upside to its current price.

Exploring Other Perspectives

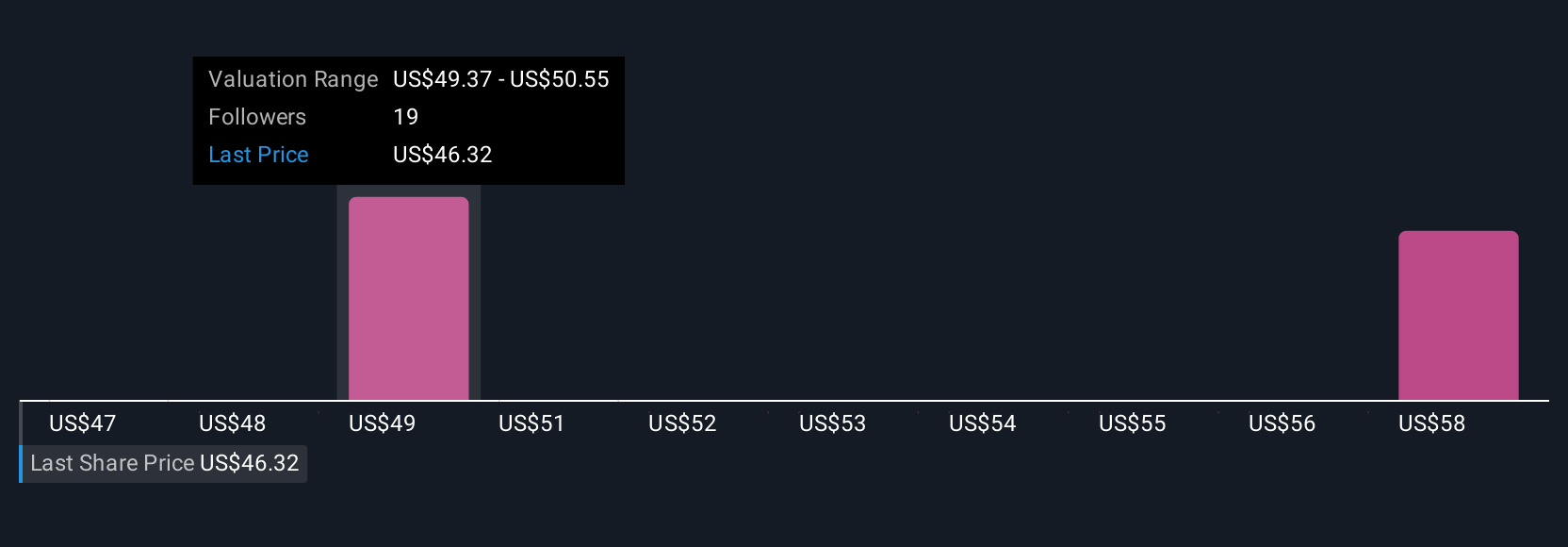

Four members of the Simply Wall St Community currently estimate Baker Hughes’ fair value between US$50 and about US$70.81, underlining how far opinions can stretch. Against that spread, the company’s continued reliance on LNG and gas power growth for long term expansion highlights why you may want to compare several different views on how policy or technology shifts could affect future demand.

Explore 4 other fair value estimates on Baker Hughes - why the stock might be worth just $50.00!

Build Your Own Baker Hughes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baker Hughes research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Baker Hughes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baker Hughes' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal