Rigetti Computing (RGTI) Is Down 6.6% After Quantum Pullback Highlights Cash Burn And Dilution Risks

- In November, Rigetti Computing was swept up in a broad quantum computing sector pullback as investors refocused on high cash burn, widening losses, and limited current revenues across the industry.

- The retreat has thrown fresh attention on Rigetti’s ambitious roadmap to scale its quantum processors past 100 qubits by 2025 and toward 1,000-plus qubits by 2027, despite persistent funding and dilution risks.

- We’ll now examine how the sector-wide concerns over cash burn and dilution shape Rigetti’s investment narrative for long-term investors.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Rigetti Computing's Investment Narrative?

To own Rigetti today, you have to buy into a very simple idea: that its superconducting, modular roadmap to 100+ qubits by 2025 and 1,000+ qubits by 2027 will one day justify years of deep losses and limited revenue. November’s roughly 40% pullback, triggered by sector-wide worries about cash burn and dilution, did not change the near term technical catalysts much: execution on the chiplet-based systems, delivery of the US$5.7 million Novera QPUs, and progress under government contracts like the US$5.8 million AFRL award still matter most. What it has changed is the emphasis on risk. With Q3 net losses soaring to about US$201 million and shareholders already diluted over the past year, the market is now openly questioning how Rigetti will fund that roadmap without further pressure on existing owners.

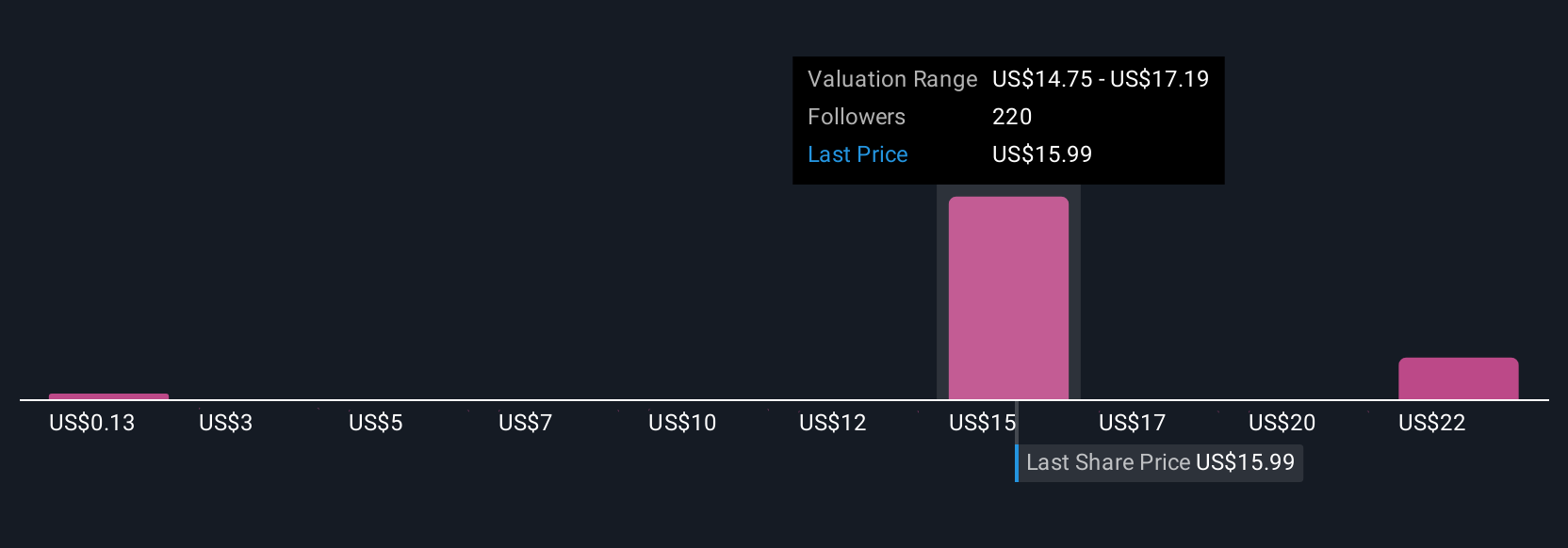

However, investors should also be aware of how future capital raises might affect their slice of the pie. Our comprehensive valuation report raises the possibility that Rigetti Computing is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 49 other fair value estimates on Rigetti Computing - why the stock might be worth less than half the current price!

Build Your Own Rigetti Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigetti Computing research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Rigetti Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigetti Computing's overall financial health at a glance.

No Opportunity In Rigetti Computing?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal