What Adobe (ADBE)'s Arabic-First AI Partnership With HUMAIN Means For Shareholders

- At the U.S.-Saudi Investment Forum in November 2025, HUMAIN and Adobe announced a global partnership to build culturally grounded generative AI models and applications for the Middle East, anchored in Arabic-first language capabilities and regional data centers.

- This collaboration positions Adobe to embed HUMAIN's ALLAM Arabic-first LLM across products like Acrobat and Firefly, potentially deepening adoption in Arabic-speaking markets and broadening its AI infrastructure footprint.

- We’ll now explore how Adobe’s deep integration of HUMAIN’s Arabic-first AI layer could influence its existing investment narrative built around AI adoption.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Adobe Investment Narrative Recap

To own Adobe, you need to believe its AI infused creative and experience cloud will keep deepening customer lock in, even as competition in generative AI intensifies. The HUMAIN partnership reinforces Adobe’s push into emerging markets and local-language AI, but it does not fundamentally change the near term catalyst around proving AI monetization in upcoming earnings, nor the key risk that complex third party model integration could weigh on margins if execution slips.

The HUMAIN alliance sits naturally alongside Adobe’s broad Firefly and GenStudio rollout, which is already embedding generative AI across Creative Cloud and Experience Cloud. Where Firefly targets global, brand safe content creation at scale, ALLAM’s Arabic first capabilities could help extend that story into high growth Middle Eastern use cases, linking the existing AI product suite to a potentially larger, more localized customer base if adoption takes hold.

Yet beneath the AI excitement, investors should not ignore how rising competition in creative AI could still challenge Adobe’s pricing power and market share over time...

Read the full narrative on Adobe (it's free!)

Adobe's narrative projects $29.3 billion revenue and $8.7 billion earnings by 2028. This requires 9.0% yearly revenue growth and about a $1.8 billion earnings increase from $6.9 billion today.

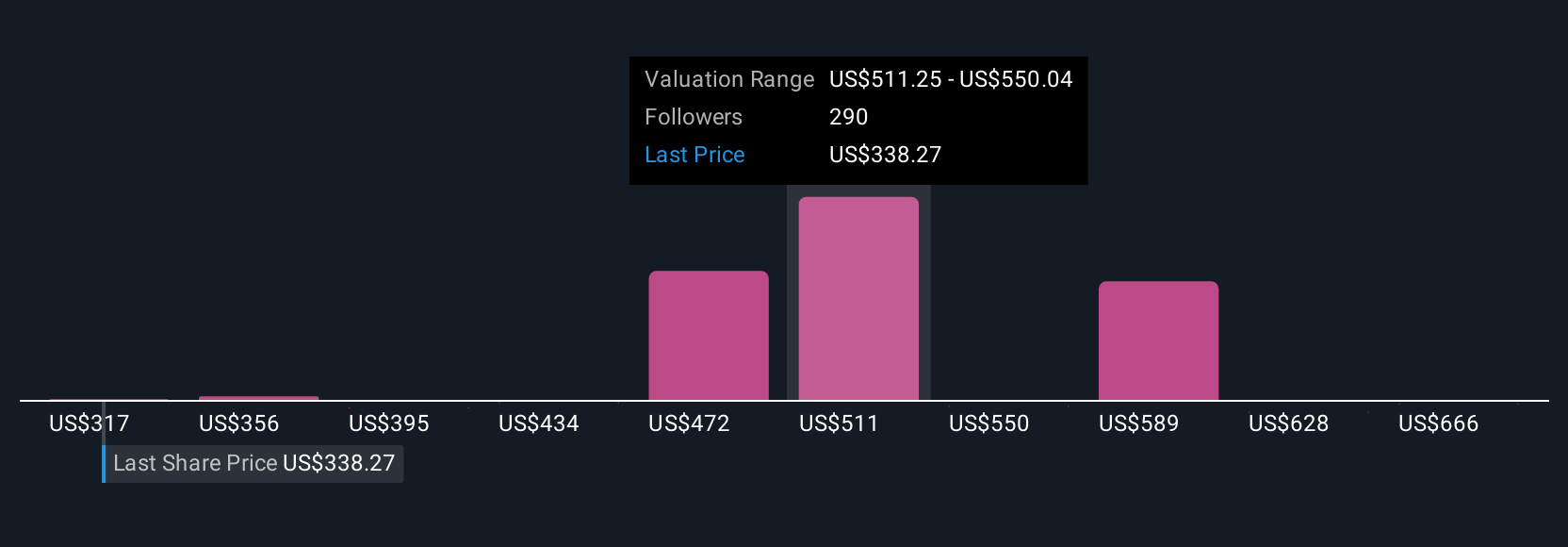

Uncover how Adobe's forecasts yield a $450.32 fair value, a 40% upside to its current price.

Exploring Other Perspectives

While the baseline view focuses on steady AI driven growth, the most optimistic analysts were already assuming revenue could reach about US$31.2 billion by 2028 before this HUMAIN news, so you should expect that some of those upbeat narratives may adjust as the real world results of these partnerships and emerging market bets become clearer.

Explore 87 other fair value estimates on Adobe - why the stock might be worth just $380.00!

Build Your Own Adobe Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adobe research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Adobe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adobe's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal