Does MPW’s Liquidity Focus Hint at Sustainable Income or Underlying Business Shift?

- Medical Properties Trust announced that its Board of Directors declared a regular quarterly cash dividend of $0.09 per share, payable on January 8, 2026, to shareholders of record as of December 11, 2025.

- Alongside maintaining its dividend, the company reported improved liquidity and no remaining debt maturities in 2025 following refinancing activities.

- We’ll discuss how Medical Properties Trust’s focus on liquidity enhancement strengthens its investment narrative and outlook for income reliability.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Medical Properties Trust Investment Narrative Recap

To be a shareholder in Medical Properties Trust, you need to believe in the long-term resilience of healthcare real estate and the company’s ability to stabilize rental income through tenant transitions and liquidity management. The recent announcement of a maintained dividend and renewed liquidity, following refinancing that leaves no 2025 debt maturities, helps support income reliability but does not significantly change the main short-term catalyst, ramping up rental payments from new operators on previously distressed assets. The biggest near-term risk, tenant concentration and credit quality, remains largely unchanged by this news.

One of the most relevant recent announcements is the new lease agreement with NOR Healthcare Systems Corp. for six hospital facilities, which adds US$45 million in annual rent with deferred payments. This deal is important as it aims to replace income previously lost from challenged tenants, potentially contributing to the crucial catalyst of improving cash rent coverage as Medical Properties Trust seeks stability after a period of distressed asset transitions.

By contrast, the continued high exposure to tenants with uncertain long-term financial strength is a key consideration investors should be aware of, especially as ...

Read the full narrative on Medical Properties Trust (it's free!)

Medical Properties Trust's outlook anticipates $1.1 billion in revenue and $136.7 million in earnings by 2028. This scenario is based on a 3.1% annual revenue growth rate and an earnings improvement of $1.54 billion from current earnings of -$1.4 billion.

Uncover how Medical Properties Trust's forecasts yield a $5.07 fair value, a 12% downside to its current price.

Exploring Other Perspectives

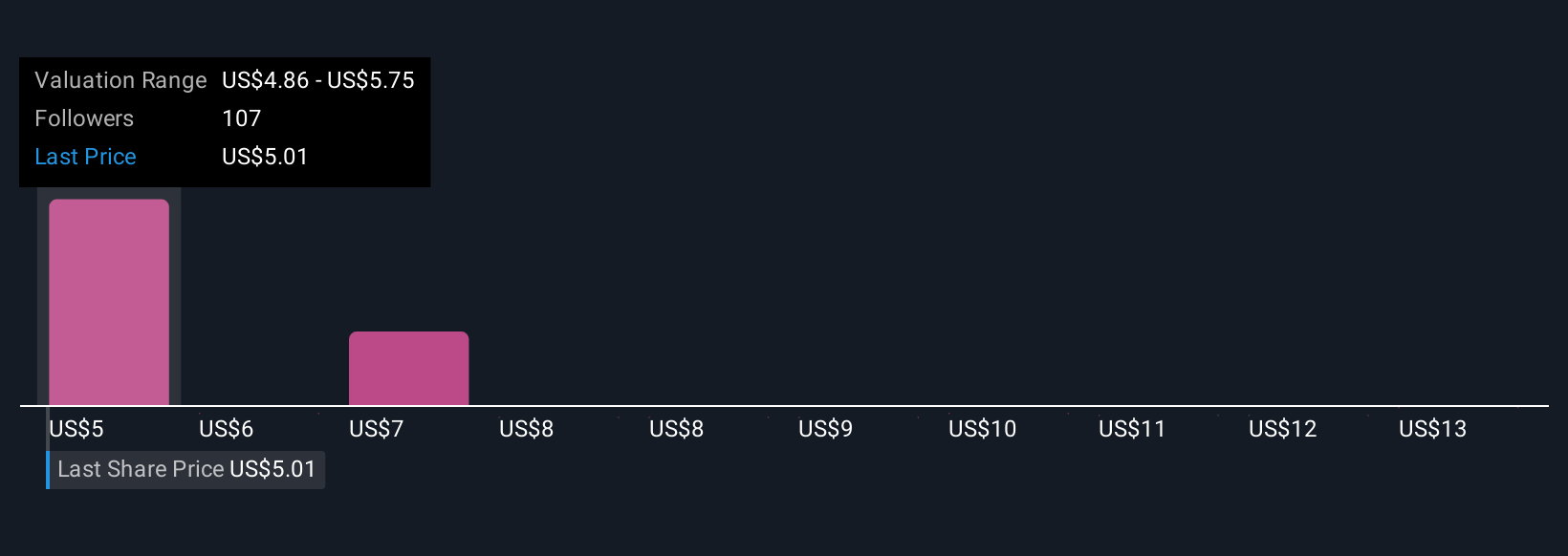

Fair value estimates from 11 Simply Wall St Community members span a wide range, from US$5.07 to US$13.43 per share. While many see upside, the ongoing risk of revenue and earnings volatility from re-tenanting distressed properties highlights why opinions on the outlook for Medical Properties Trust can be so divided, explore the breadth of community views now.

Explore 11 other fair value estimates on Medical Properties Trust - why the stock might be worth over 2x more than the current price!

Build Your Own Medical Properties Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Medical Properties Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Medical Properties Trust's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal