A Look at Vishay Intertechnology’s (VSH) Valuation Following Latest Automotive and Industrial Product Launches

Vishay Intertechnology (VSH) has rolled out two new products this month: a 1500 V automotive-grade solid-state relay and a high-durability thick film power resistor. These products are targeted at battery management and energy storage solutions across electric vehicle and industrial sectors.

See our latest analysis for Vishay Intertechnology.

Vishay Intertechnology's steady flow of product innovation comes amid a period of mixed momentum for its shares. After a brief bounce in the past week, with a 7-day share price return of 9.3%, the stock is still navigating a challenging stretch, as shown by a 1-year total shareholder return of -26.7% and a 5-year total return of -25.7%. While the latest dividend and new products have sparked some renewed interest, longer-term performance suggests investors remain cautious, weighing the turnaround potential against recent declines.

If Vishay’s push into next-gen automotive tech has you watching the sector, it might be the right moment to discover See the full list for free.

With shares still lagging over multiple years despite a bounce and new product launches, the question remains: is Vishay currently undervalued, or has the market already accounted for its potential recovery and future growth prospects?

Most Popular Narrative: 2.4% Undervalued

With Vishay’s last close at $13.67, the most widely followed narrative suggests the stock is trading just below its estimated fair value. The narrative invites a closer look at ambitious growth assumptions and upside potential driven by sector megatrends.

With major multi-year investments in capacity expansion nearing completion, including readiness across nearly all product lines and the ramp of high-growth, higher-profit products, Vishay is well positioned to capture share as demand accelerates in areas like AI, smart grid infrastructure, data centers, and automotive electrification. This supports higher future revenues and improved operating leverage.

Curious what ambitious projections are driving this edge? There is a bold blueprint here, hinting at rapid profit turnarounds and sector-defying margin expansion, but the real numbers may surprise you. Ready to discover which industry shifts the narrative is betting on, and what is factored into that near-fair price? Dive in to uncover the story behind the estimate.

Result: Fair Value of $14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operational inefficiencies or a delayed demand rebound could quickly undermine optimism. This could potentially pressure margins and challenge the turnaround thesis.

Find out about the key risks to this Vishay Intertechnology narrative.

Another View: DCF Model Paints a Different Picture

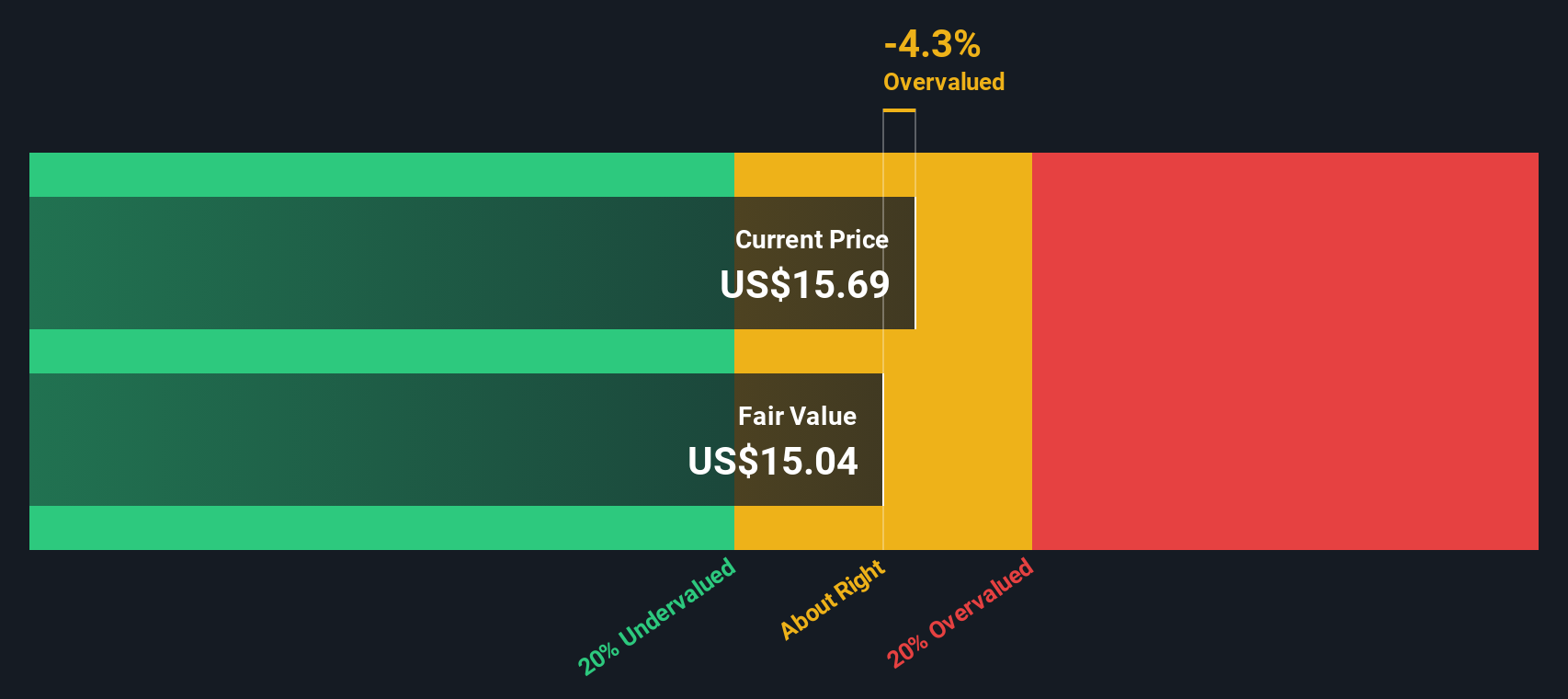

While the fair value estimate based on growth narratives sees Vishay as slightly undervalued, our DCF model suggests a distinctly different outlook. According to the SWS DCF model, the stock is priced above its underlying fair value, raising questions about the magnitude and likelihood of projected turnarounds. Which valuation should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vishay Intertechnology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vishay Intertechnology Narrative

If you see a different story in the numbers or want to investigate your own angle, it’s easy to dive in and shape a personal thesis in under three minutes. Do it your way.

A great starting point for your Vishay Intertechnology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock the next wave of opportunities. Don’t let your watchlist miss out on exceptional stock prospects highlighted by the Simply Wall Street Screener.

- Capitalize on the AI boom by checking out these 25 AI penny stocks, which are reshaping entire industries with intelligent automation and massive data analytics.

- Secure stronger passive income streams with these 15 dividend stocks with yields > 3%, featuring companies offering attractive yields above 3% and solid financial track records.

- Position yourself ahead of the crowd with these 920 undervalued stocks based on cash flows, where you’ll find stocks analysts believe are priced below their true worth based on robust cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal