Is Cabot's (CBT) Leadership Transition Shaping Operational Strategy for Long-Term Value Creation?

- Cabot Corporation recently appointed William (Bill) Masterson as senior vice president and president of its Reinforcement Materials segment, effective November 21, 2025, succeeding Matthew Wood, whose departure was not related to any company disagreement.

- Masterson’s extensive background in managing global operations and commercial strategy at Cabot highlights the company’s focus on operational expertise in key leadership roles.

- We’ll explore how Masterson’s appointment, with his track record of operational leadership, could influence Cabot’s investment narrative going forward.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is Cabot's Investment Narrative?

For anyone considering Cabot as an investment today, the story hinges on believing in the company’s ability to translate operational expertise and strategic innovation into improving fundamentals, despite a period of sales and earnings pressure. The recent appointment of Bill Masterson to lead the Reinforcement Materials segment comes against a backdrop of consecutive quarters of lower revenue and shrinking profit margins, factors that have weighed on the stock price and short-term momentum. While Masterson’s global operations acumen aligns with Cabot's continued push toward efficiency and product innovation, including expansions in circular carbons and new battery materials, it’s too soon to expect a material shift in near-term performance or major catalysts. However, leadership transitions at this level can help mitigate execution risk and strengthen Cabot’s position, which may influence perceptions of future stability and the ability to unlock value from new technologies. For now, existing risks, such as muted revenue growth and high debt, still remain at the forefront, and the impact of leadership change should be monitored closely in upcoming results and strategic updates.

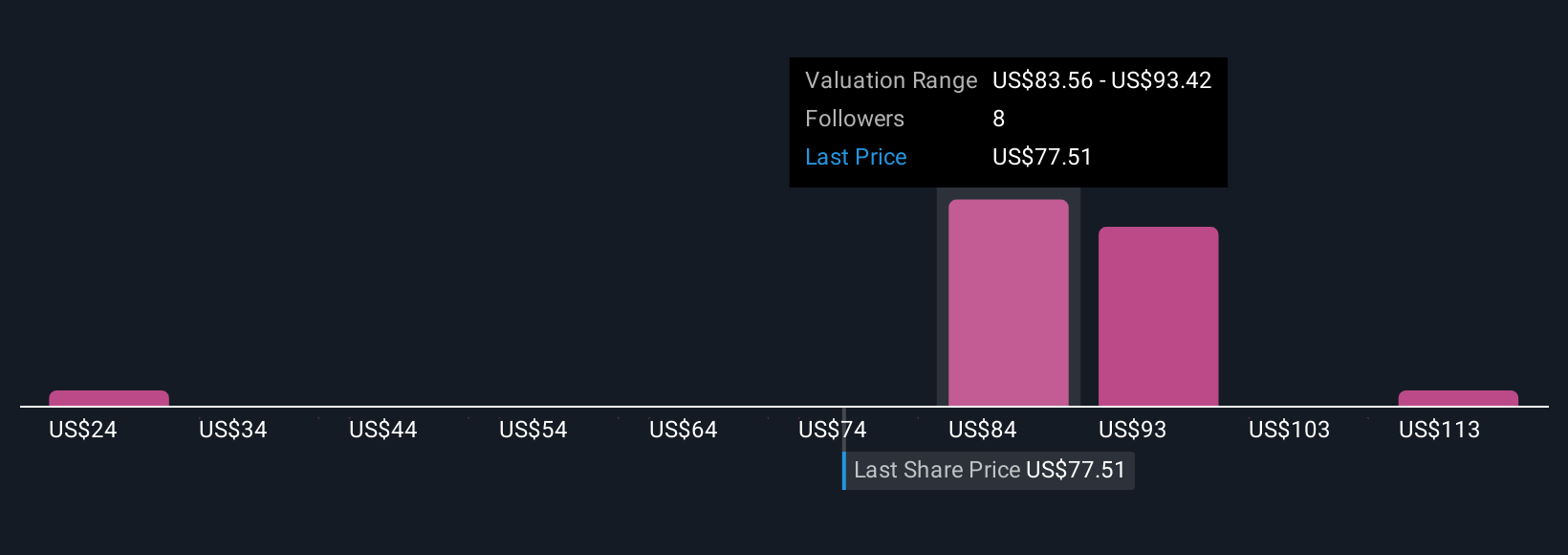

But compared with peers, Cabot’s relatively high debt remains a key factor investors should weigh. Cabot's shares have been on the rise but are still potentially undervalued by 23%. Find out what it's worth.Exploring Other Perspectives

Explore 5 other fair value estimates on Cabot - why the stock might be worth less than half the current price!

Build Your Own Cabot Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cabot research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cabot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cabot's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal