Is Weaker Q3 Output and New 2025 Guidance Shifting the Case for Antero Resources (AR)?

- Antero Resources recently announced third-quarter 2025 earnings that missed analyst expectations, with weaker oil production and higher operating expenses, but saw improvements compared to the previous year’s loss.

- The company also provided 2025 production and capital expenditure guidance, highlighting management’s outlook on operational priorities and budgeting for the coming year.

- We'll explore how the updated production guidance and capital budget inform Antero Resources' broader investment narrative and future outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Antero Resources Investment Narrative Recap

At its core, owning Antero Resources depends on confidence in the long-term relevance of US natural gas exports and the firm’s ability to manage costs and production margins amid shifting energy markets. The recent third-quarter earnings miss does not appear to alter this central thesis in a major way, though it does underscore the ongoing importance of expense control as a key short-term focus and highlights persistent risks around production volatility.

Among recent company announcements, Antero’s updated 2025 production guidance of 3.4–3.45 Bcfe/d and a capital budget of US$650 million to US$675 million stands out as most relevant. These targets indicate a focus on disciplined spending and operational predictability, which are crucial watchpoints given the backdrop of fluctuating commodity prices and mounting regulatory scrutiny. Yet for investors, even as the company signals allocation prudence, it is important to weigh the possibility that...

Read the full narrative on Antero Resources (it's free!)

Antero Resources is forecast to achieve $6.1 billion in revenue and $745.2 million in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 7.9% and an earnings increase of approximately $266 million from current earnings of $478.9 million.

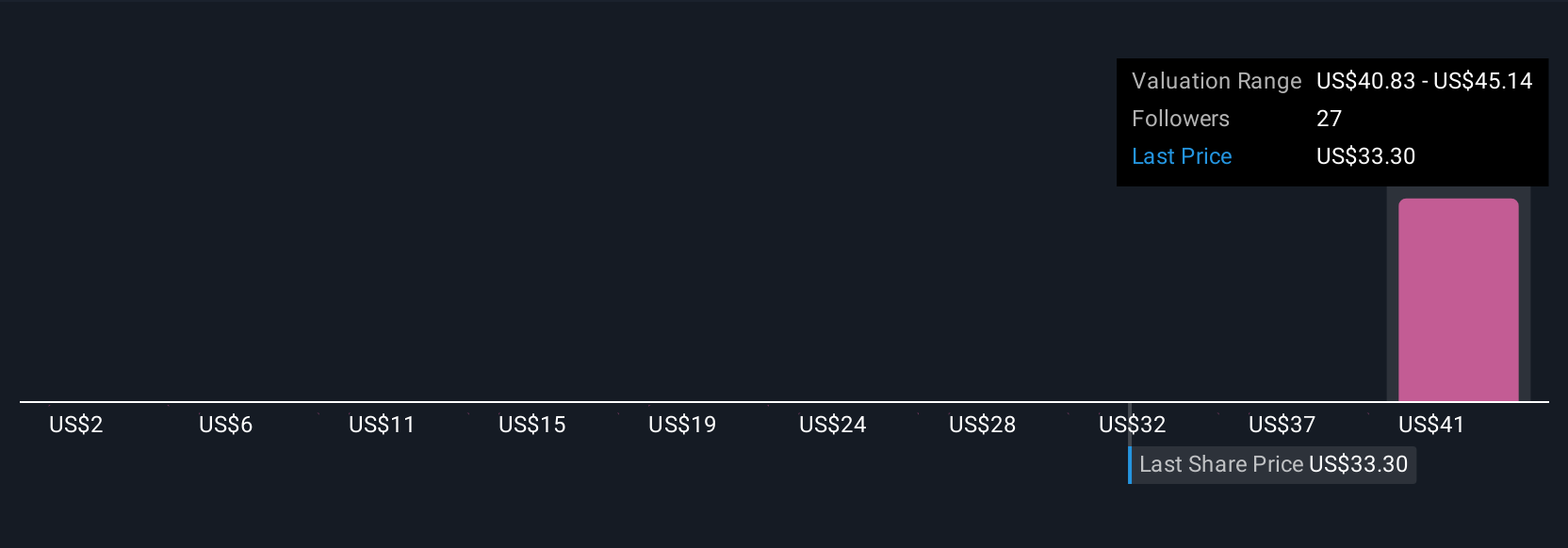

Uncover how Antero Resources' forecasts yield a $42.10 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members assessed Antero Resources’ fair value between US$29 and US$97, with three distinct estimates represented. Ongoing price volatility and pipeline constraints could affect whether these wide-ranging views play out as expected, so you can compare several perspectives here.

Explore 3 other fair value estimates on Antero Resources - why the stock might be worth over 2x more than the current price!

Build Your Own Antero Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Antero Resources research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Antero Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Antero Resources' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal