Will DHC’s Debt Reduction Plan Reshape Its Long-Term Flexibility and Value Proposition?

- Citizens recently reiterated its Market Perform rating on Diversified Healthcare Trust after the company released its third-quarter 2025 results, highlighting improvements in its senior housing operating portfolio, including increased year-over-year occupancy despite earlier disruptions.

- A unique aspect of this update is management's clear plan to address high-cost debt by the first quarter of 2026, using asset sales and a credit facility to significantly enhance financial flexibility.

- We'll examine how the company’s proactive debt repayment strategy could influence Diversified Healthcare Trust's long-term investment case.

Find companies with promising cash flow potential yet trading below their fair value.

Diversified Healthcare Trust Investment Narrative Recap

Investors in Diversified Healthcare Trust need to believe that ongoing improvements in senior housing occupancy and active debt management can outweigh the company’s persistent challenges. The recent news of rising occupancy and management’s plan to address high-cost debt by early 2026 supports the most important short-term catalyst: balance sheet de-risking. However, these updates do not materially alter the biggest risk, which remains the company’s reliance on successful asset sales to reduce leverage at a time when market demand for healthcare real estate could fluctuate.

Among recent announcements, the completion of the $375 million private note offering in September 2025 is particularly relevant. Proceeds have already been used to redeem legacy debt, providing a measure of near-term relief for interest obligations and advancing the company’s progress on liquidity and financial flexibility, directly tied to catalysts highlighted by management. The contrast for investors to consider is that despite these proactive steps, the underlying risk tied to asset sales at potentially unfavorable prices remains a key issue to watch...

Read the full narrative on Diversified Healthcare Trust (it's free!)

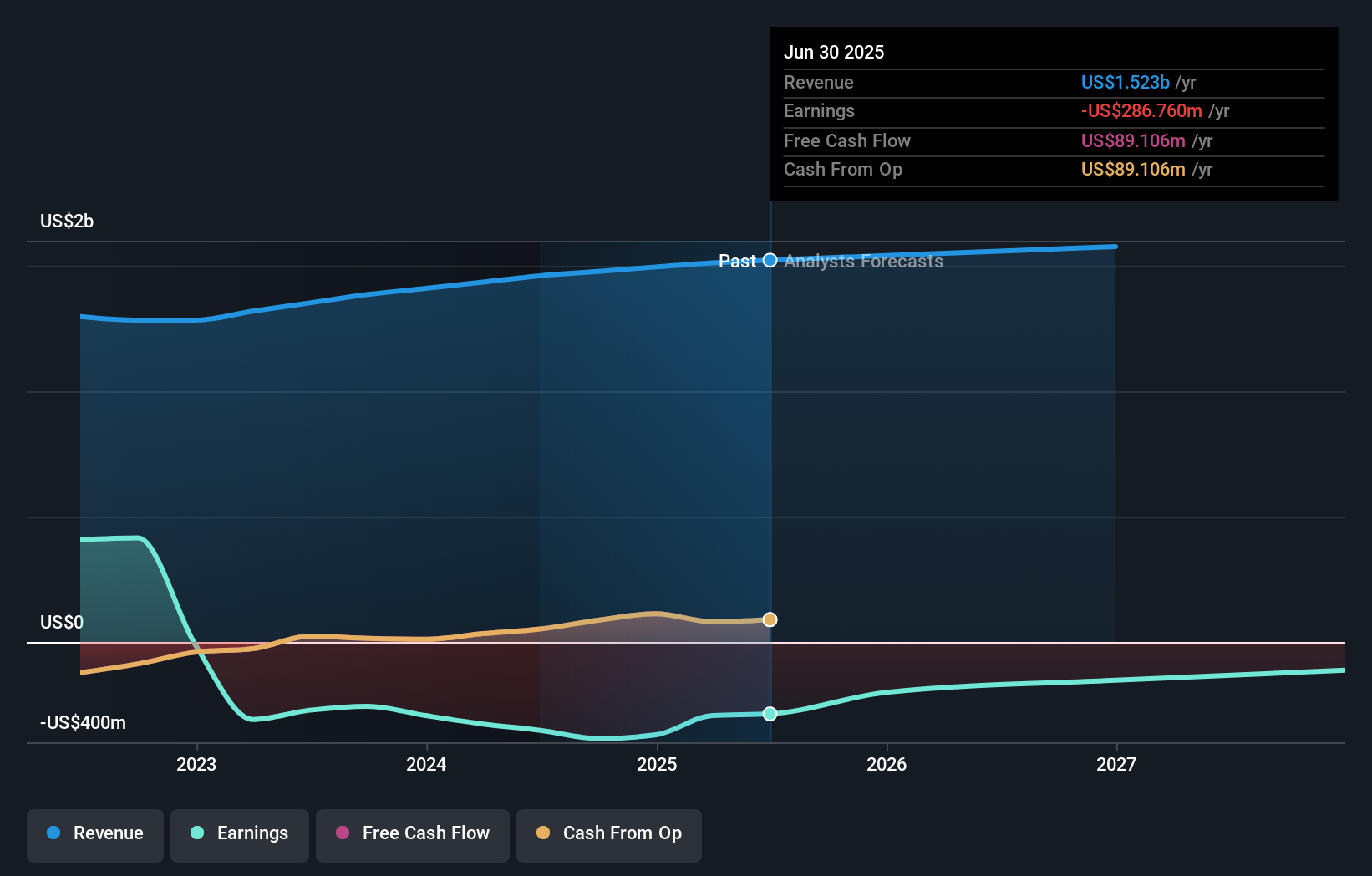

Diversified Healthcare Trust's narrative projects $1.6 billion in revenue and $381.0 million in earnings by 2028. This requires a 2.4% yearly revenue growth and a $667.8 million increase in earnings from the current level of -$286.8 million.

Uncover how Diversified Healthcare Trust's forecasts yield a $5.25 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community for DHC range from US$4.03 to US$5.25 per share. While community members weigh future revenue potential, the ongoing reliance on asset sales adds a layer of uncertainty to the company’s stability and earnings outlook. Explore more opinions and analysis from fellow investors.

Explore 2 other fair value estimates on Diversified Healthcare Trust - why the stock might be worth 15% less than the current price!

Build Your Own Diversified Healthcare Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diversified Healthcare Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Diversified Healthcare Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diversified Healthcare Trust's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal