A Fresh Look at Extra Space Storage’s Valuation Following New $600M Joint Venture with Blue Vista and UBS

Extra Space Storage (EXR) has partnered with Blue Vista Capital Management and UBS’s real estate division, launching a $600 million joint venture focused on acquiring and developing self-storage properties across the United States. This move highlights the company’s strategy to expand its market leadership and diversify its portfolio.

See our latest analysis for Extra Space Storage.

The new joint venture comes at a time when Extra Space Storage is actively flexing its industry muscle, but recent share price action suggests the market is taking a wait-and-see approach. After a strong run in previous years (five-year total shareholder return of 40.65%), the stock’s 12.51% drop over the past month and 19.42% 1-year total shareholder return point to fading momentum. The company continues to pay out healthy dividends and expand aggressively, but investors appear to be weighing the long-term growth story against near-term uncertainty.

If you’re curious which other companies combine strong growth profiles with savvy insider backing, now’s the perfect moment to discover fast growing stocks with high insider ownership

With shares trading about 25% below some analyst estimates and a newly announced joint venture improving long-term prospects, investors are left to wonder whether Extra Space is still undervalued or if the market is already pricing in its next phase of growth.

Most Popular Narrative: 15.5% Undervalued

The most widely followed narrative values Extra Space Storage at $155.65, notably above its recent close of $131.46. This suggests analysts see upside if key drivers play out, despite recent market hesitation.

*Discipline in M&A and capital allocation (for example, strategic focus on JV buyouts, accretive Life Storage integration, and optimizing the portfolio through selective dispositions) enables Extra Space to scale efficiently and respond quickly to new supply and demand headwinds. This may potentially enhance margins and drive long-term EBITDA growth.*

Curious about the math behind this valuation? There is a bold mix of future profit margin expansion, slow headline growth, and a price-to-earnings expectation that tops the sector’s usual range. The missing piece? Which assumption really tips the scales on fair value—discover exactly what makes this narrative tick inside.

Result: Fair Value of $155.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high property tax growth and continued oversupply in key regions could put pressure on profitability and challenge the bullish valuation narrative.

Find out about the key risks to this Extra Space Storage narrative.

Another View: Market Multiples Tell a Different Story

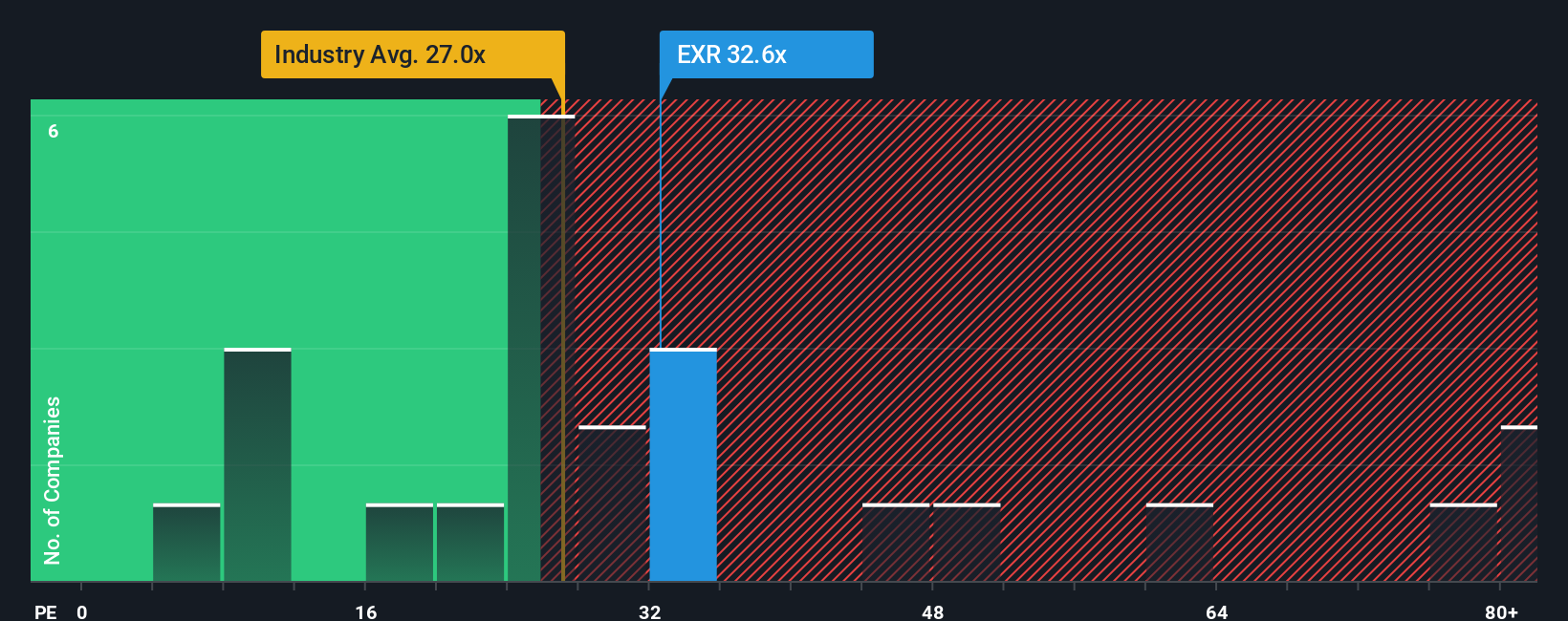

Looking through the lens of market ratios, Extra Space Storage currently trades at a price-to-earnings ratio of 29.4x, which is steeper than both the industry average of 28.3x and peers at 27.3x. While our fair ratio estimate is 33.4x, this gap highlights some valuation risk if market sentiment deteriorates. Could the market be pricing in more growth than is likely, or is there potential upside if fundamentals surprise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Extra Space Storage Narrative

If you see the story differently or want to dig into the numbers yourself, you can build your own fresh perspective quickly. Do it your way

A great starting point for your Extra Space Storage research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for less. Expand your watchlist and uncover fresh opportunities in the market with these handpicked stock ideas from Simply Wall Street’s powerful screener tools.

- Boost your portfolio’s income by tapping into these 15 dividend stocks with yields > 3%, offering reliable dividends with yields above 3%, perfect for balancing growth with steady cash flow.

- Jump ahead of the curve by targeting future-shaping companies making waves in artificial intelligence. See which ones stand out among these 26 AI penny stocks and seize early-mover advantages.

- Strengthen your position with these 927 undervalued stocks based on cash flows, revealing stocks the market may be overlooking, based on solid cash flow fundamentals and real upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal