Should CMS Energy’s (CMS) $13 Billion Clean Energy Push Reshape Investors’ View on Its Long-Term Strategy?

- Consumers Energy, a CMS Energy subsidiary, recently announced plans to invest more than US$13 billion through 2029 in renewable energy and grid infrastructure, with ongoing policy support in Michigan for clean power development and grid resilience.

- This initiative includes continued operation of a major coal plant under emergency orders and approval of new solar and wind projects, targeting enhanced grid reliability and a transition toward net-zero emissions by 2040.

- We’ll look at how Consumers Energy’s US$13 billion clean energy investment shapes CMS Energy’s investment narrative and long-term growth outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CMS Energy Investment Narrative Recap

To be a CMS Energy shareholder today, you need to believe in Michigan’s push for cleaner power and the company's ability to execute a major US$13 billion clean energy transformation, while managing funding requirements and regulatory support. The recently declared preferred stock dividend has little direct impact on CMS’s most important short-term catalyst: visible progress on its large-scale investments. The biggest near-term risk, potential need for debt or equity financing to fund these projects, remains largely unchanged by this announcement.

The US$850 million fixed-income offering announced earlier is highly relevant. It ties directly to the capital demands of the company’s renewables and grid investments, and brings the funding strategy into sharper focus for investors closely watching leverage and cost of capital as catalysts for future returns.

By contrast, if regulatory support in Michigan were to weaken, that’s a risk investors should keep in mind...

Read the full narrative on CMS Energy (it's free!)

CMS Energy's outlook projects $9.2 billion in revenue and $1.4 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 4.6% and a $0.4 billion increase in earnings from the current $1.0 billion level.

Uncover how CMS Energy's forecasts yield a $78.31 fair value, a 5% upside to its current price.

Exploring Other Perspectives

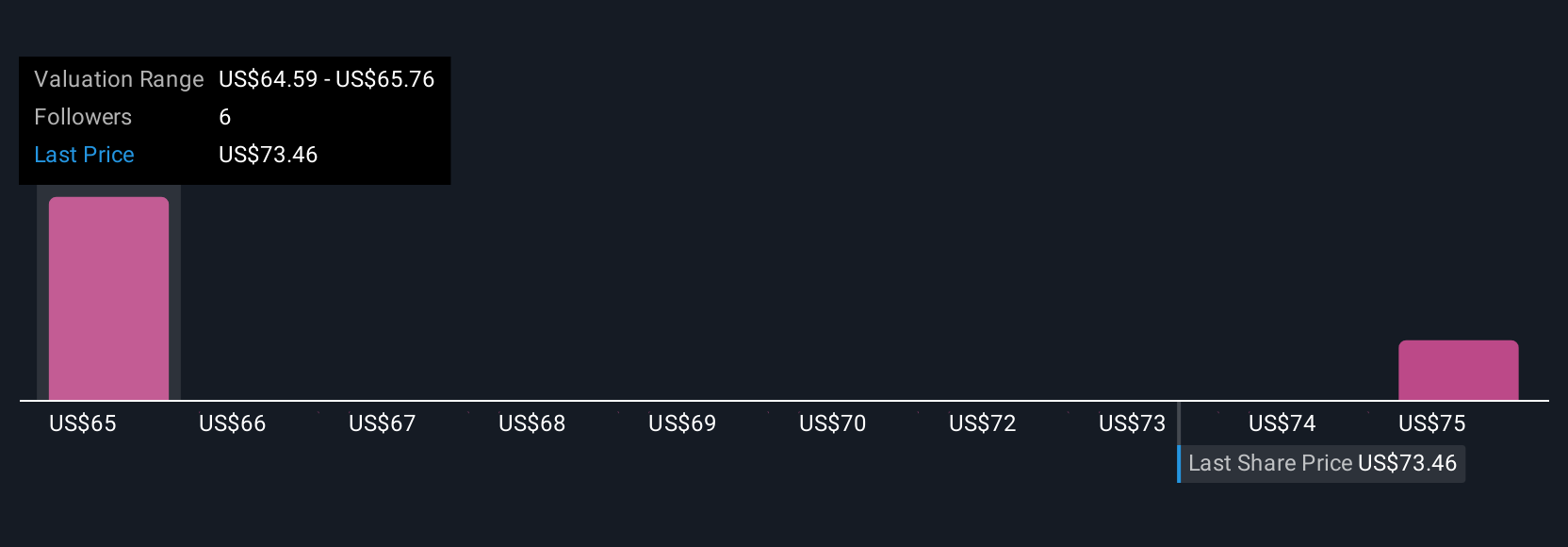

Two private investors in the Simply Wall St Community estimated CMS Energy’s fair value from US$64.63 to US$78.31 per share, offering a range of viewpoints. With ambitious infrastructure upgrades underway, it is clear market participants see the potential for wide differences in opinion about long-term growth and funding needs.

Explore 2 other fair value estimates on CMS Energy - why the stock might be worth 13% less than the current price!

Build Your Own CMS Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CMS Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free CMS Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CMS Energy's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal