Is Cabot's (CBT) Innovation Recognition Hinting at Shifts in Its Clean Energy Strategy?

- Cabot Corporation recently announced that its LITX® 95F conductive carbon was named one of the “Top 10 Exhibits of 2025” at the 8th China International Import Expo in Shanghai, recognizing its innovation in specialty chemicals for lithium-ion energy storage.

- This recognition highlights Cabot’s contributions to advancing cleaner energy technologies and expanding its presence in the rapidly growing energy storage sector.

- Let’s explore how Cabot’s recognition for enabling lithium-ion storage highlights the company’s evolving role in the clean energy landscape.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Cabot's Investment Narrative?

For anyone considering Cabot stock, the case has always centered on its position in the specialty chemicals sector, plus a growing footprint in clean energy storage. What stands out now is the major industry recognition for LITX 95F, positioning Cabot at the forefront of lithium-ion battery technology. While this news showcases Cabot’s innovative edge and relevance to the energy transition, the immediate impact on top-line results or near-term catalysts appears limited, as evidenced by continued analyst caution and muted share price response. The company still faces key risks: weak year-over-year sales and earnings declines, alongside pressures from slower-than-market expected revenue growth and a high debt level. These challenges have persisted despite buybacks and dividend increases, so any shift in sentiment or valuation will most likely hinge on tangible financial improvement rather than product awards alone.

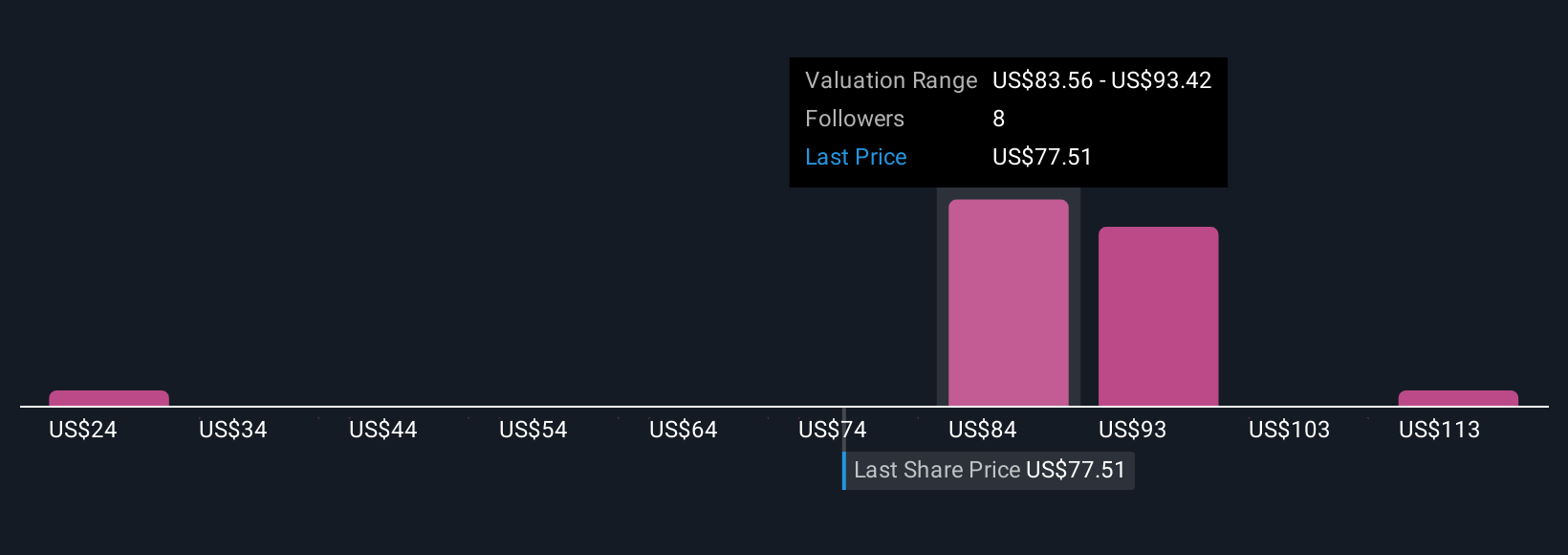

Yet, high debt remains a critical risk investors should watch closely. Despite retreating, Cabot's shares might still be trading 44% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 5 other fair value estimates on Cabot - why the stock might be worth over 2x more than the current price!

Build Your Own Cabot Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cabot research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cabot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cabot's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal