AbCellera Biologics (NasdaqGS:ABCL): Valuation in Focus After Board Changes and Latest Earnings Reveal Net Losses

AbCellera Biologics (NasdaqGS:ABCL) has made a couple of leadership changes, appointing Dr. Stephen Quake to its Board while Andrew W. Lo steps down. These changes come at the same time the company released new quarterly results.

See our latest analysis for AbCellera Biologics.

AbCellera Biologics' leadership shakeup and recent earnings release have come as the stock endures a volatile ride. Although the year-to-date share price return is a solid 18.8%, momentum has faded lately. The 30-day share price dropped by 35.6%. Still, long-term shareholders are up 35.9% on a 1-year total return basis, even after accounting for recent declines.

If executive moves and shifting sentiment have you wondering where the next opportunity lies, consider exploring biotech and pharma standouts in our See the full list for free..

With recent board changes and volatile performance, investors are left to consider whether AbCellera’s falling share price offers a compelling entry point or if the current valuation already reflects the company’s future prospects.

Most Popular Narrative: 64.7% Undervalued

Analyst consensus suggests AbCellera Biologics could have considerable upside, with the estimated fair value far above the last close. With shares at $3.60 and a narrative fair value of $10.20, the forecast gap is striking and raises the stakes around future growth projections and profitability milestones.

The completion of AbCellera's integrated clinical manufacturing capabilities by the end of 2025 is likely to enhance operational efficiency and reduce COGS, potentially improving net margins as the company begins utilization of these capabilities. Financial backing with over $630 million in liquidity and additional funding commitments provides AbCellera with the necessary resources to support long-term pipeline development, enhancing potential future earnings through successful commercialization of their clinical candidates.

What’s fueling such a huge potential upside? Two bold numbers stand at the heart of this upbeat scenario and they are not just about sales. Want to know how ambitious future profits and valuation multiples could swing the story? Dig in now for the details that build this fair value target.

Result: Fair Value of $10.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, clinical trial setbacks or continued high R&D expenses could quickly shift sentiment and challenge the current positive valuation narrative.

Find out about the key risks to this AbCellera Biologics narrative.

Another View: Is AbCellera Still Expensive?

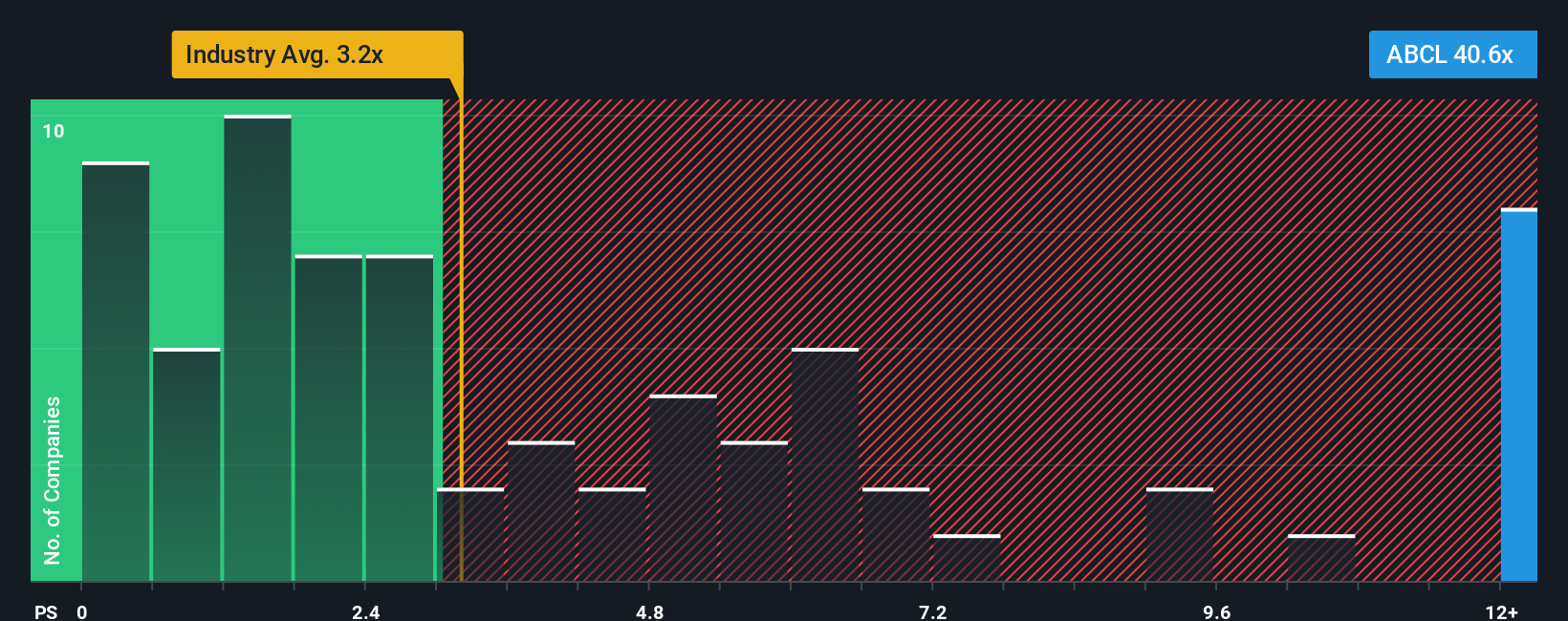

Looking at the price-to-sales ratio, AbCellera trades at 30.5x, which is much higher than both the peer average of 4.2x and the US Life Sciences industry at 3.3x. This significant gap suggests investors expect a lot of growth or are taking on higher valuation risk. Could the price move closer to peers if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AbCellera Biologics Narrative

If you want to see how your own insights stack up, the platform lets you craft a personalized take on AbCellera’s outlook in just a few minutes. Your perspective might reveal opportunities others have missed. Do it your way.

A great starting point for your AbCellera Biologics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always have an edge by expanding their watchlist beyond one stock. Your next opportunity could be just a click away if you check out more handpicked, high-potential investments using the tools below.

- Catch the potential of ground-breaking technology with these 26 quantum computing stocks and position yourself at the forefront of innovation.

- Boost your passive income by screening for stocks paying out strong yields through these 18 dividend stocks with yields > 3%, and strengthen your portfolio’s foundation.

- Ride the next tech trend and target companies powering artificial intelligence by starting with these 26 AI penny stocks today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal