Can Dr. Quake’s Arrival Offset AbCellera Biologics (ABCL) Board Changes and Widening Losses?

- Earlier this month, AbCellera Biologics announced the appointment of renowned scientist and entrepreneur Dr. Stephen Quake as an independent director, the departure of board member Dr. Andrew W. Lo, and the upcoming exit of SVP of Development Dr. Geoff Nichol, alongside reporting third-quarter 2025 earnings showing revenue growth to US$8.96 million with net losses widening to US$57.12 million.

- Dr. Quake’s extensive scientific, academic, and entrepreneurial background, recently recognized by his election as a Foreign Member of the Royal Society, signals a significant addition to the company’s leadership as it continues to advance its internal pipeline and clinical-stage programs.

- We’ll look at how Dr. Quake’s board appointment alongside rising quarterly losses may shape AbCellera Biologics’ current investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AbCellera Biologics Investment Narrative Recap

The central belief behind owning shares in AbCellera Biologics is confidence that its clinical pipeline, led by assets like ABCL635, will mature into commercially successful medicines, offsetting current widening net losses. The recent board appointment of Dr. Stephen Quake, while a positive for leadership depth, does not materially alter the short-term catalyst of clinical trial progress, nor lessen the risk from ongoing high R&D spending and broader earnings losses.

Of the recent updates, the dosing of first participants in the Phase 1 trial for ABCL575 is most relevant for investors focused on near-term pipeline milestones. As AbCellera pivots toward a clinical-stage biotech, actual patient dosing marks a key step toward validating the company’s transition and revenue outlook tied to its internal pipeline, which remains the central focus for prospective shareholders.

However, it's important for investors to consider that despite scientific progress, the risk of continued high cash burn and increasing net losses could...

Read the full narrative on AbCellera Biologics (it's free!)

AbCellera Biologics is projected to reach $123.3 million in revenue and $17.5 million in earnings by 2028. This forecast assumes an annual revenue growth rate of 55.4% and an earnings increase of $183.2 million from the current earnings of -$165.7 million.

Uncover how AbCellera Biologics' forecasts yield a $10.20 fair value, a 176% upside to its current price.

Exploring Other Perspectives

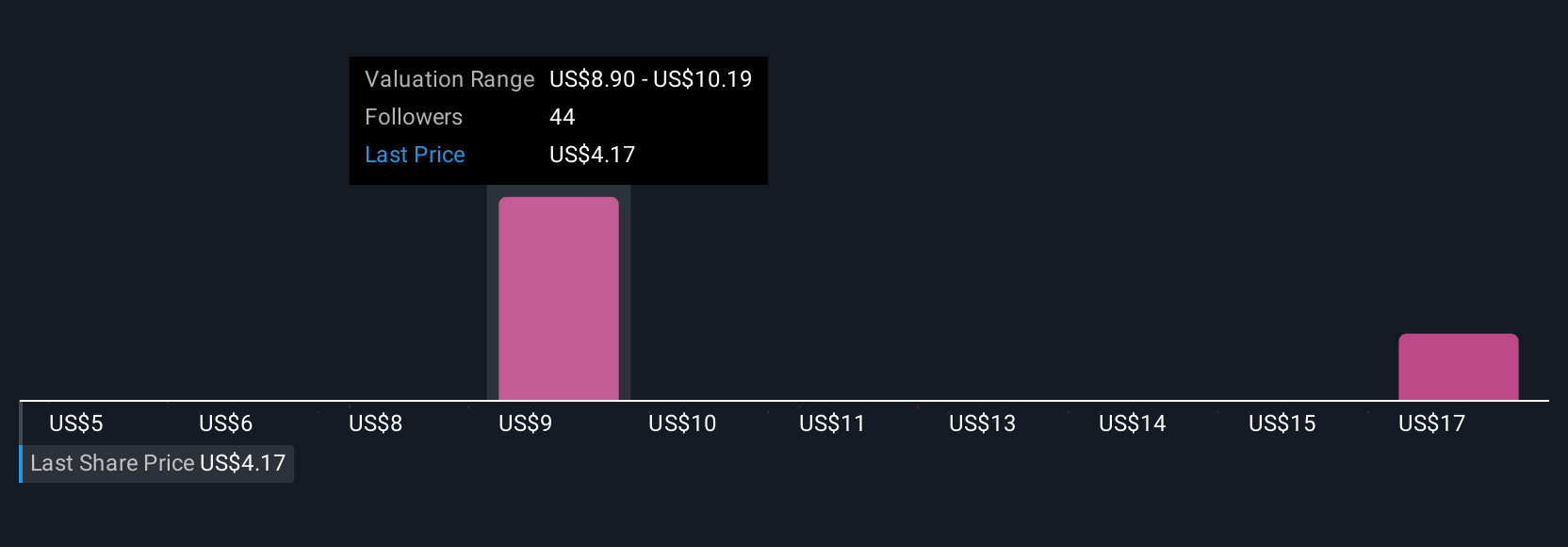

Simply Wall St Community contributors estimate AbCellera’s fair value between US$5 and US$17, reflecting nine independent views. While opinions differ widely, high R&D expenses and net losses in the latest results sharpen the debate over how quickly pipeline progress can translate to financial improvement, consider multiple viewpoints as you form your outlook.

Explore 9 other fair value estimates on AbCellera Biologics - why the stock might be worth just $5.00!

Build Your Own AbCellera Biologics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AbCellera Biologics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AbCellera Biologics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AbCellera Biologics' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal