What Vicor (VICR)'s Strong AI Demand and Insider Sale Mean For Shareholders

- In late October 2025, Vicor’s Corporate Vice President Claudio Tuozzolo exercised 20,145 stock options and immediately sold the resulting shares following the company’s third-quarter announcement.

- Vicor’s Q3 results significantly outperformed analyst expectations, primarily due to heightened demand for high-density power systems in AI data centers, spotlighting the firm's expanding relevance in transformative technology markets.

- We’ll examine how Vicor’s exceptional AI-driven Q3 results could shift its investment narrative and future market positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Vicor Investment Narrative Recap

For shareholders, the core belief in Vicor rests on sustained demand for high-density power solutions as AI and advanced computing drive data-center growth. The company’s recent Q3 earnings surprise, with profits and revenue far exceeding expectations, is a strong short-term catalyst and temporarily overshadows near-term order volatility. However, insider selling by a top executive following the stock’s surge does not materially alter the key risk: uncertain order flow, especially given previous downturns flagged in backlog and book-to-bill metrics.

The recent update on Vicor’s ongoing share buyback program is especially relevant here, as it shows the company actively investing in itself during this period of strong momentum. With over 747,000 shares repurchased and US$33.82 million spent since July 2024, the program could help support share price stability, though its impact depends on sustained underlying demand rather than short-term financial maneuvers.

By contrast, order instability, particularly from China and exposure to tariff and cancellation risks, remains information that investors should be aware of...

Read the full narrative on Vicor (it's free!)

Vicor's narrative projects $523.8 million in revenue and $45.4 million in earnings by 2028. This requires 11.4% annual revenue growth but a $20.1 million decrease in earnings from the current $65.5 million level.

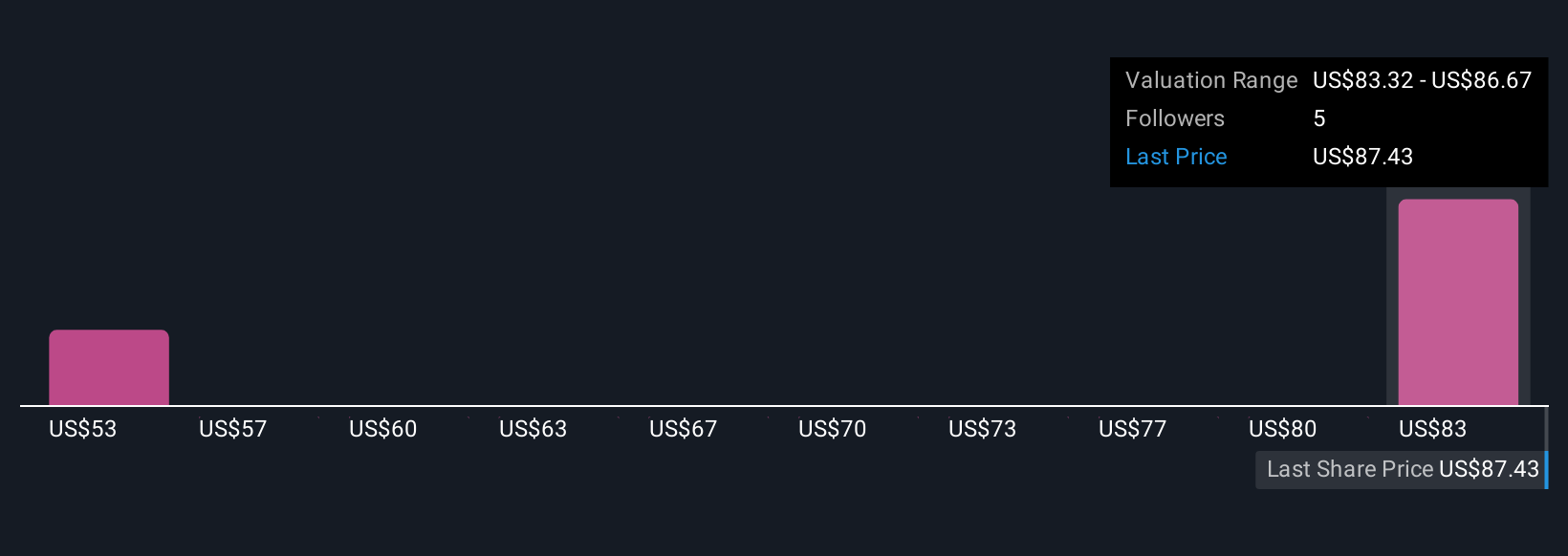

Uncover how Vicor's forecasts yield a $86.67 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted two fair value estimates for Vicor, ranging from US$53.34 to US$86.67 per share. While investors’ fair value opinions differ widely, continued volatility in customer demand and orders could shape how these perspectives play out; consider how these different views might influence your own research.

Explore 2 other fair value estimates on Vicor - why the stock might be worth as much as $86.67!

Build Your Own Vicor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vicor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vicor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vicor's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal