Will Warby Parker’s (WRBY) Lowered Revenue Outlook Challenge Its Tech-Driven Growth Story?

- Warby Parker Inc. recently reported its third-quarter 2025 results, with sales rising to US$221.68 million and net income improving to US$5.87 million from a net loss a year ago, yet missing analyst revenue expectations and lowering its full-year revenue outlook.

- The company's ongoing growth in active customers, retail expansion, and introduction of AI-driven eyewear partnerships signal evolving approaches amid competitive and economic pressures.

- We will examine how Warby Parker's reduced revenue guidance shapes the investment narrative given its customer and technology initiatives.

Find companies with promising cash flow potential yet trading below their fair value.

Warby Parker Investment Narrative Recap

For investors to own Warby Parker shares today, they need to have confidence in the company's ability to deliver sustainable growth through expanding its active customer base, retail presence, and technology partnerships like AI eyewear, despite intensifying competition and a backdrop of economic uncertainty. The recent miss on Q3 revenue expectations and the company’s lowered full-year guidance now put a sharper spotlight on the pace of customer and revenue growth, which remains the top catalyst, while also highlighting the risk of market share and margin pressure. While these results indicate strong profitability improvement, the more cautious sales outlook is a meaningful development for short-term expectations.

Among recent announcements, Warby Parker’s partnership with Google to create AI-powered glasses directly ties into efforts to drive higher-margin growth beyond traditional eyewear, showing an appetite for innovation that could complement its retail expansion and potentially reshape the growth trajectory outlined in its updated guidance.

But against this push into new technology, there remains an ongoing risk that aggressive store expansion could outpace market demand and pressure margins, something investors should be aware of as...

Read the full narrative on Warby Parker (it's free!)

Warby Parker's narrative projects $1.2 billion revenue and $85.4 million earnings by 2028. This requires 14.8% yearly revenue growth and a $94.6 million increase in earnings from -$9.2 million today.

Uncover how Warby Parker's forecasts yield a $25.08 fair value, a 46% upside to its current price.

Exploring Other Perspectives

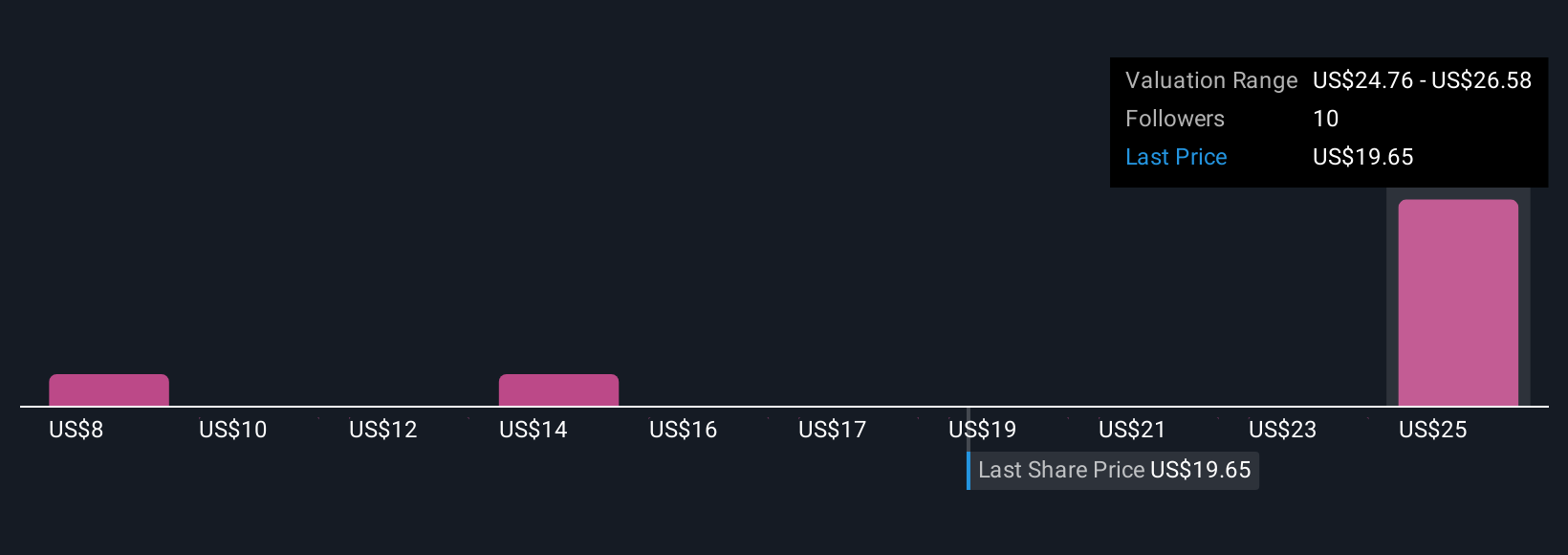

Fair value estimates from the Simply Wall St Community span a wide range, from US$8.37 to US$25.60, based on five individual analyses. As opinions on Warby Parker’s prospects differ, the increased market focus on revenue execution and margin preservation makes it important to weigh several viewpoints before forming any conclusions.

Explore 5 other fair value estimates on Warby Parker - why the stock might be worth as much as 49% more than the current price!

Build Your Own Warby Parker Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Warby Parker research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Warby Parker research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Warby Parker's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal