Nexa Resources (NYSE:NEXA): Losses Widen, Profitability Forecast in 3 Years Challenges Recovery Narrative

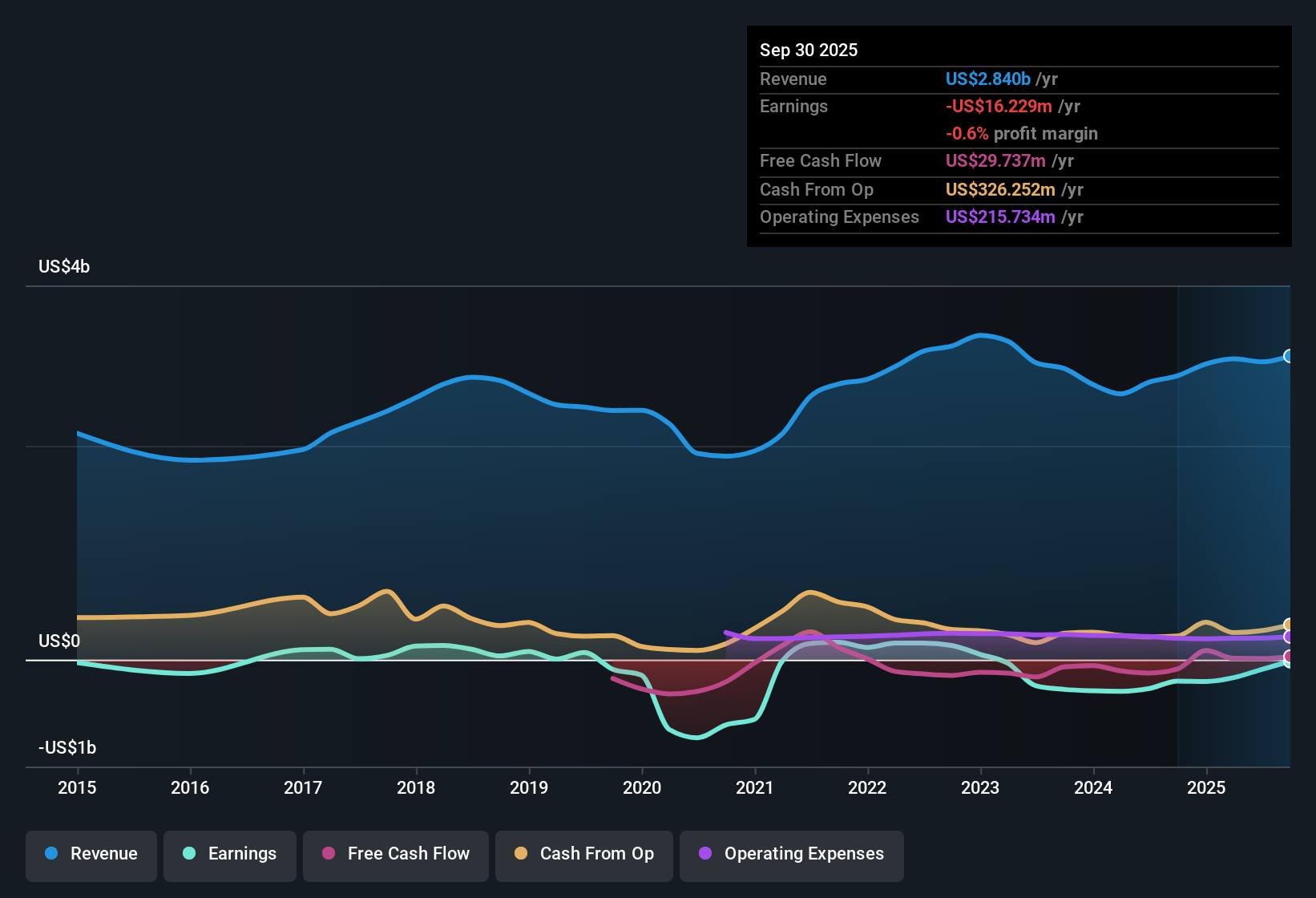

Nexa Resources (NYSE:NEXA) remains unprofitable, with losses growing at an average rate of 8.6% per year over the past five years. Forecasts call for earnings to accelerate at an annual rate of 21.95%, with profitability expected within three years. Meanwhile, revenue is projected to grow at a slower 2% per year, trailing the broader US market’s pace. Investors will be weighing the strong outlook for future profitability and discounted valuation against these more modest revenue expectations.

See our full analysis for Nexa Resources.Next up, we compare Nexa Resources’ headline figures with the prevailing narratives driving market sentiment. This shows where the consensus story aligns with the latest results and where it does not.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Widen but Turnaround Timeline Remains Aggressive

- Nexa’s losses have been increasing at an annual rate of 8.6% over the last five years, but company projections place a return to profitability within three years. This puts Nexa well ahead of the broader market’s average turnaround pace.

- Forecasts point to annual earnings growth of 21.95%, a growth path that heavily supports the view Nexa can break even faster than many peers despite its rising losses.

- What is surprising is this rapid improvement is expected despite only slow annual revenue gains of 2%. This suggests management’s focus may be on margin recovery and cost controls rather than top-line expansion.

Trading at a Sharp Discount to Peers

- Nexa’s price-to-sales ratio sits at 0.3x, significantly below the industry average of 2.8x and the peer group’s 12.3x. This reflects a market valuation that is well below sector norms.

- The company’s share price of $5.81 trails its estimated DCF fair value of $7.19, which supports the view among some investors that the stock is undervalued with room for rerating if profitability materializes.

- Still, this discount persisted even as no material risks were flagged in the latest filings. This hints at investor skepticism about Nexa’s ability to hit aggressive profit targets rather than concerns over its fundamentals.

Profit Growth Outpaces Revenue Expansion

- The expected annual earnings growth rate of 21.95% significantly outpaces projected revenue growth of just 2%. This highlights a scenario where margin expansion rather than sales is anticipated to drive improvements in the bottom line.

- This scenario underlines a pivotal contrast for investors: while top-line sales are set to lag the broader US market’s 10.3% revenue growth, Nexa’s forecast improvement in earnings could appeal to those who prize profitability over pure sales acceleration.

- What stands out is that this profile positions Nexa as a recovery story, with returns likely to depend on successful execution of cost controls and margin uplift rather than new growth engines.

Results like these highlight why some investors see a discounted opportunity while others remain unconvinced Nexa can deliver on aggressive profit growth without stronger sales momentum. See what the community is saying about Nexa Resources

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nexa Resources's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Nexa’s slow revenue growth and reliance on margin improvement highlight a lack of consistent top-line and bottom-line expansion, which underscores operational uncertainty.

If steady results appeal to you, use our stable growth stocks screener (2103 results) to find companies that deliver reliable growth in both sales and profits, no matter the market climate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal