Myers Industries (MYE): $25.9 Million One-Off Loss Fuels Margin Drop, Tests Bullish Narratives

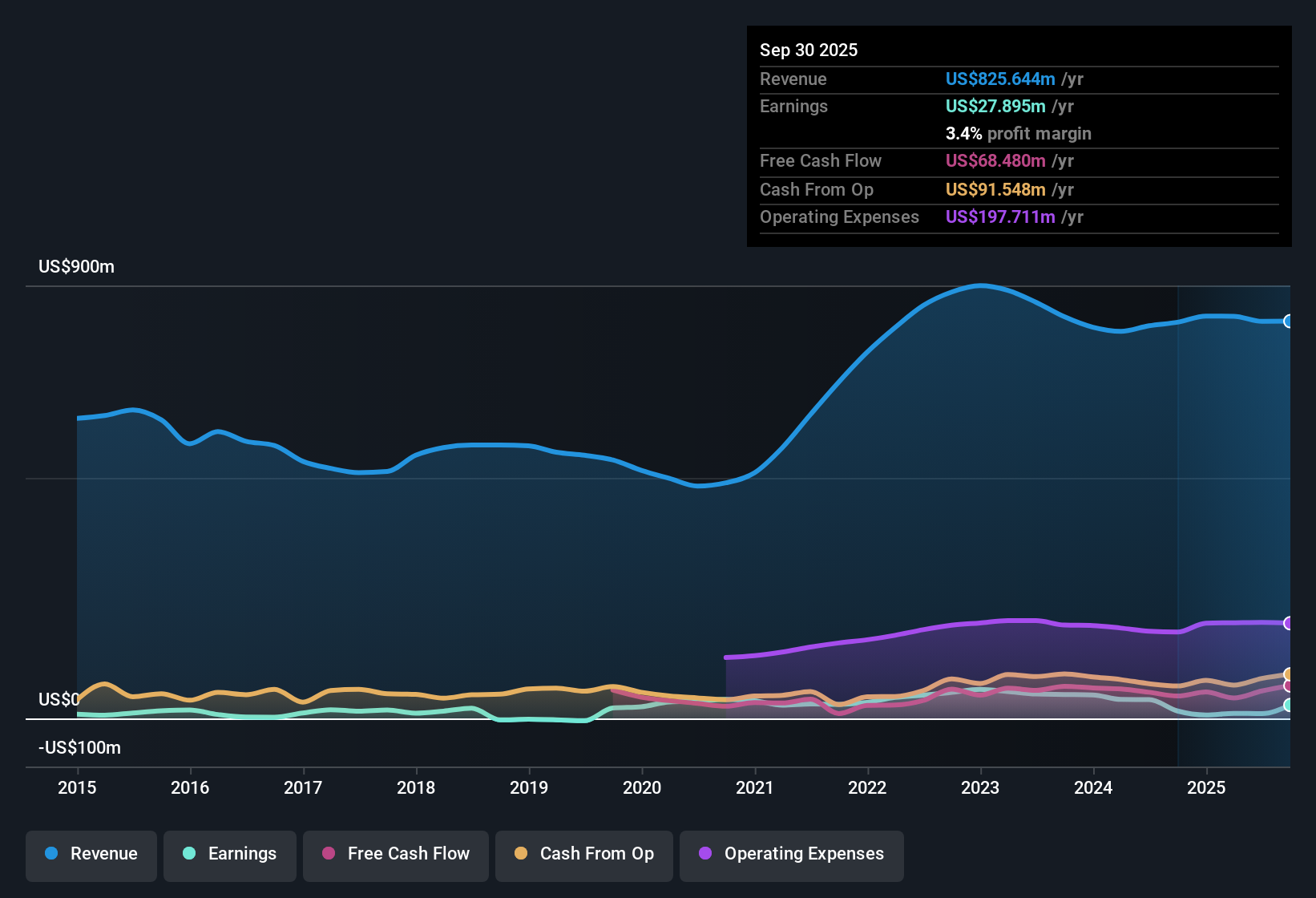

Myers Industries (MYE) posted a net profit margin of 1.2% for the latest twelve months, dropping steeply from 4.8% a year prior, weighed down by a significant one-off loss of $25.9 million. Earnings have contracted by an average of 10.8% annually over the last five years, and the stock currently trades at a price-to-earnings ratio of 63.5x, well above both the global packaging industry average of 15.9x and the peer group’s 21.5x. While shares are priced below a recent fair value estimate, persistent margin pressure and recent earnings declines have left investors weighing valuation potential against notable operating headwinds.

See our full analysis for Myers Industries.Next up, we will put these earnings in context by comparing the data to the major narratives investors are following. This will highlight where expectations and reality might diverge.

See what the community is saying about Myers Industries

Analyst Margin Targets Far Outpace Current Performance

- Sell-side forecasts see profit margin jumping from 1.2% today to 19.1% in three years, a bold assumption given recent margin headwinds.

- Analysts' consensus view expects this future leap to be driven by facility consolidation and SG&A cost cuts, supporting EBITDA margin expansion and growing profitability from the existing business.

- Consensus narrative notes that the consolidation of rotational molding facilities and reduction in SG&A should unlock durable efficiency gains over the next 18 months.

- However, this projection comes against a backdrop of declining margins and earnings contraction, making execution risk a central factor that could diverge sharply from these optimistic margin assumptions.

For investors weighing if profit improvement is realistic or risky optimism, see how management’s plan matches up to the consensus narrative predictions. 📊 Read the full Myers Industries Consensus Narrative.

High Valuation Despite Prolonged Earnings Slump

- The company trades at a 63.5x price-to-earnings ratio, which is nearly three times its peer group’s 21.5x average, despite five years of average annual earnings decline at 10.8%.

- Analysts' consensus view points out a stark disconnect: to justify the analyst price target of 21.0, Myers would need to boost earnings from $9.9 million to $163.9 million by 2028, and see its P/E multiple contract sharply to 5.9x on those future earnings.

- Consensus narrative highlights that the current valuation premium hinges on a belief in major operational and profit improvements, which are much steeper than the sector trend or the company’s own recent track record.

- This tension raises the stakes for successful execution of strategic initiatives, as sustained underperformance could leave the stock at risk of de-rating toward more modest industry multiples.

Operational Overhaul Faces Demand Headwinds

- Recent results were hit by a one-off $25.9 million loss, and consensus narrative flags ongoing demand weakness in automotive and aftermarket segments, with management projecting vehicle-related markets to remain pressured.

- Analysts' consensus view notes that while strategic refocusing through potential divestiture of the Myers Tire Supply business could streamline operations and improve financial stability, it also increases reliance on fewer markets.

- This refocus enables Myers to channel capital and resources into higher-growth and sustainable packaging/infrastructure, but may also amplify earnings volatility if sector-specific downturns persist.

- Consensus narrative further highlights that industry shifts, heightened competition, and potential material changes (such as a move to biodegradable products) add longer-term uncertainty around demand volumes and pricing power.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Myers Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures in a new light? If you have fresh insights or a unique angle, why not shape your own narrative in just minutes by creating one yourself — Do it your way.

A great starting point for your Myers Industries research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

See What Else Is Out There

Myers Industries faces steep valuation, ongoing margin declines, and ambitious improvement forecasts that carry significant execution risk. This situation may leave investors exposed to underperformance.

If you're seeking stocks with more reasonable valuations and brighter upside, check out these 848 undervalued stocks based on cash flows for companies trading at compelling prices compared to their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal