Palantir Technologies (NasdaqGS:PLTR) Partners To Revolutionize Nuclear Construction With AI-Driven Solutions

Palantir Technologies (NasdaqGS:PLTR) recently announced a strategic partnership with The Nuclear Company, which focuses on advancing nuclear power deployment in the U.S. by co-developing an AI-driven software system. This collaboration, alongside multiple alliances, could have bolstered investor confidence, contributing to Palantir's 59% share price increase over the last quarter. While the market generally rose by 12% over the past year, Palantir's substantial returns may have been significantly lifted by these partnerships and raised earnings guidance, aligning with their broader growth strategy amidst a dynamic sector landscape.

We've identified 1 possible red flag for Palantir Technologies that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past three years, Palantir Technologies' shares have experienced a remarkable surge, achieving a total return of over 1448% during this period. This far outpaces the recent one-year market increase of 12%, and demonstrates robust performance exceeding the US Software industry's 19.7% growth over the same timeframe. The recent strategic partnerships and raised earnings guidance appear to be significant catalysts driving this upward trajectory in shareholder returns.

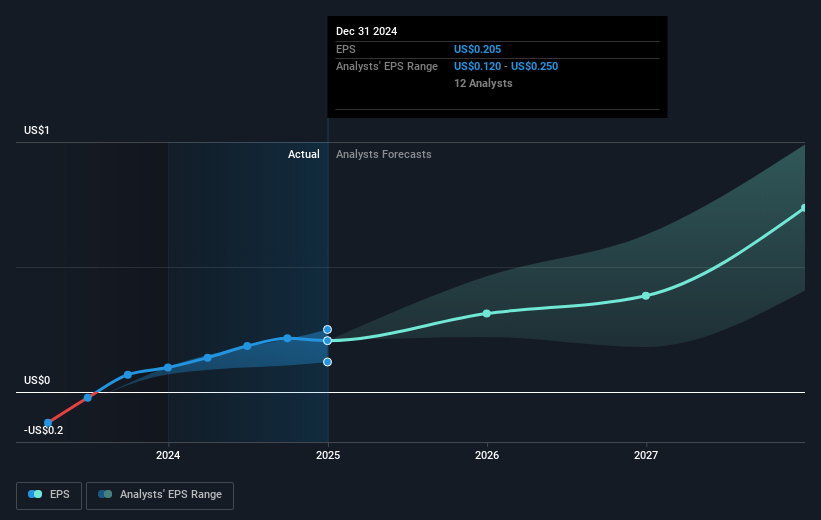

The alliances mentioned in the introduction and enhancements in Palantir's operations could potentially bolster future revenue and earnings growth. For example, partnerships in sectors such as nuclear advancement and AI integration are likely to provide new revenue streams that align with the company's growth projections. Moreover, the firm's raised revenue guidance for 2025, projecting US$3.89 billion to US$3.90 billion, suggests a solid footing for anticipated earnings expansion.

Lastly, although Palantir's shares have seen significant movement, the current share price shows a slight premium when compared to the consensus analyst price target. This signals potential discrepancies in market valuation perceptions, given the predicted earnings and revenue growth. As the company continues to secure strategic alliances, this might play a critical role in its ongoing evaluation in the market.

Understand Palantir Technologies' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal