Promising Penny Stocks To Consider In May 2025

As the U.S. stock market holds steady, with the S&P 500 extending its winning streak and investor sentiment buoyed by easing trade tensions between the U.S. and China, attention has turned to various investment opportunities. Though "penny stock" might sound like a relic of past trading days, it still highlights smaller or less-established companies that can offer great value. By focusing on those with robust financials and clear growth trajectories, investors may find diamonds in the rough among these stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.71 | $384.78M | ✅ 3 ⚠️ 3 View Analysis > |

| Perfect (NYSE:PERF) | $1.81 | $186.38M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.175 | $198.45M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.31 | $54.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.56 | $88.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.50 | $20.83M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.82 | $5.85M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.33 | $75.76M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.589 | $14.59M | ✅ 3 ⚠️ 5 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.876 | $80.18M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 741 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Research Frontiers (NasdaqCM:REFR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Research Frontiers Incorporated, along with its subsidiary, develops and markets technology and devices for controlling light flow globally, with a market cap of $55.18 million.

Operations: Research Frontiers does not report specific revenue segments.

Market Cap: $55.18M

Research Frontiers, with a market cap of US$55.18 million, remains pre-revenue and unprofitable but has shown progress by reducing losses over the past five years at 13.8% annually. The company benefits from a debt-free balance sheet and sufficient cash runway for over a year based on current free cash flow. Recent developments include its SPD technology's integration into the Mercedes-Benz Vision V show car, highlighting potential in automotive applications. Despite stable weekly volatility and no significant shareholder dilution recently, challenges remain due to limited revenue generation under US$1 million annually.

- Unlock comprehensive insights into our analysis of Research Frontiers stock in this financial health report.

- Gain insights into Research Frontiers' past trends and performance with our report on the company's historical track record.

Cassava Sciences (NasdaqCM:SAVA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cassava Sciences, Inc. is a clinical stage biotechnology company focused on developing drugs for neurodegenerative diseases, with a market cap of $90.82 million.

Operations: Cassava Sciences, Inc. does not report any revenue segments as it is a clinical stage biotechnology company.

Market Cap: $90.82M

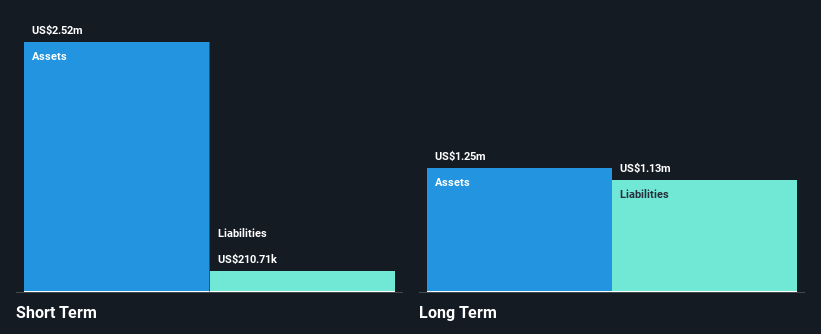

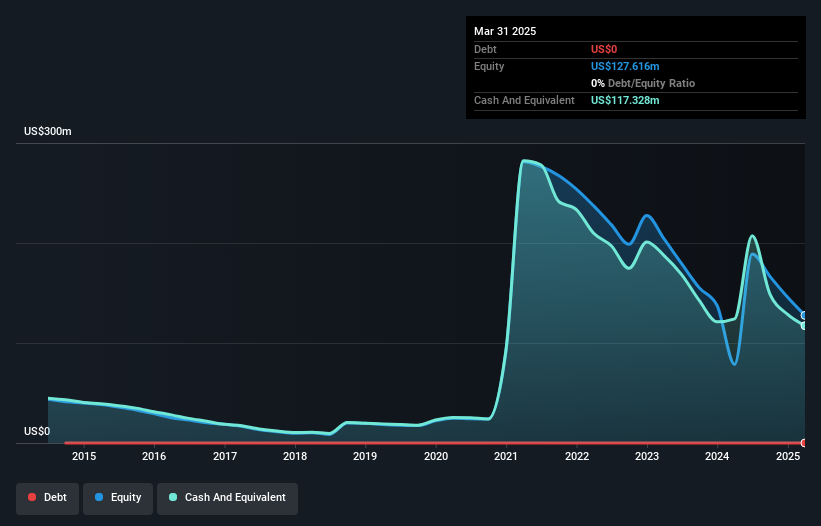

Cassava Sciences, with a market cap of US$90.82 million, is pre-revenue and faces challenges due to its unprofitability and increasing losses over the past five years. Despite having no debt and short-term assets exceeding liabilities, it has less than a year of cash runway if current cash flow trends persist. Recent executive changes include the appointment of Angélique Bordey as SVP, Neuroscience, and Jack Moore as SVP, Clinical Development. The company’s simufilam trials in Alzheimer's disease did not meet key endpoints but maintained a favorable safety profile. Volatility remains high compared to most US stocks.

- Get an in-depth perspective on Cassava Sciences' performance by reading our balance sheet health report here.

- Learn about Cassava Sciences' future growth trajectory here.

CreateAI Holdings (OTCPK:TSPH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CreateAI Holdings Inc. is an artificial intelligence technology company specializing in the production and publishing of video games and anime for digital entertainment, with a market cap of $86.86 million.

Operations: The company generates revenue from its Transportation - Trucking segment, amounting to $0.31 million.

Market Cap: $86.86M

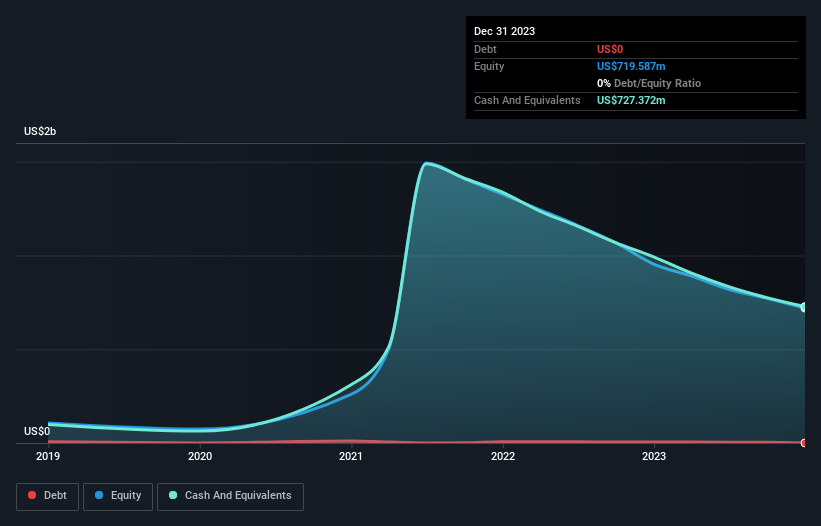

CreateAI Holdings Inc., with a market cap of US$86.86 million, is pre-revenue, generating only US$0.31 million from its Transportation - Trucking segment. The company recently launched Animon.ai, an AI platform for anime video generation, potentially transforming the ACG industry by offering unlimited content creation at a fixed subscription rate. Despite being debt-free and having short-term assets of $743.5 million exceeding liabilities, CreateAI remains unprofitable with high share price volatility and negative return on equity (-38.99%). A proposed $42.5 million legal settlement could impact financials if approved in July 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of CreateAI Holdings.

- Understand CreateAI Holdings' track record by examining our performance history report.

Taking Advantage

- Gain an insight into the universe of 741 US Penny Stocks by clicking here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal